Management Discussion and Analysis of the Summary of Operations FY 1976 vs. 1975

Bangor Punta Corporation Managements Discussion and Analysis of the Summary of Operation for the Fiscal Years Ended 30 September 1976 and 1975. P. 25 (p. 1 of 3). GGA Image ID # 15d46147a8

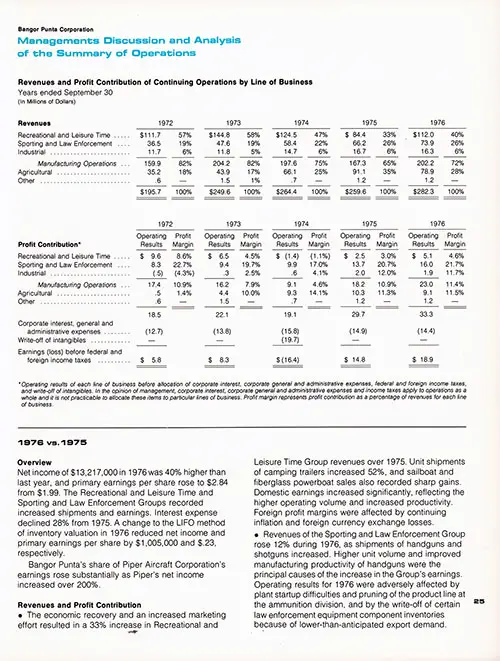

Overview

Net income of $13,217,000 in 1976 was 40% higher than last year, and primary earnings per share rose to $2.84 from $1.99. The Recreational and Leisure Time and Sporting and Law Enforcement Groups recorded increased shipments and earnings. Interest expense declined 28% from 1975.

A change to the LIFO method of inventory valuation in 1976 reduced net income and primary earnings per share by $1,005,000 and $.23, respectively.

Bangor Punta's share of Piper Aircraft Corporation's earnings rose substantially as Piper's net income increased over 200%.

Revenues and Profit Contribution

- The economic recovery and an increased marketing effort resulted in a 33% increase in Recreational and Leisure Time Group revenues over 1975. Unit shipments of camping trailers increased 52%, and sailboat and fiberglass powerboat sales also recorded sharp gains. Domestic earnings increased significantly, reflecting the higher operating volume and increased productivity. Foreign profit margins were affected by continuing inflation and foreign currency exchange losses.

- Revenues of the Sporting and Law Enforcement Group rose 12% during 1976, as shipments of handguns and shotguns increased. Higher unit volume and improved manufacturing productivity of handguns were the principal causes of the increase in the Group's earnings. Operating results for 1976 were adversely affected by plant startup difficulties and pruning of the product line at the ammunition division, and by the write-off of certain law enforcement equipment component inventories because of lower-than-anticipated export demand.

- Shipments of heat transfer equipment by the Industrial Group reached record levels during 1976, but sales of industrial ovens and conveyors declined as capital outlays by American business continued to be sluggish.

- The adoption of the LIFO valuation method for the inventories of substantially all domestic manufacturing operations reduced these inventories at September 30, 1976 by $1,933,000 from what would have been reported under the inventory accounting method used prior to the current year.

- Revenues and profit contribution of the Agricultural Group declined from the record high levels of fiscal 1975 because of a 32% reduction in the quantity of cotton ginned and both lower prices and lower volume for processed products. The decline in the level of operations can be directly attributed to the one-third reduction in acreage used by Far West growers for cotton harvested in fiscal 1976, as compared with the prior year.

Corporate Expense and Interest Expense

Corporate general and administrative expenses increased during 1976 because of higher legal and insurance costs and the cost of carrying out the court ordered rescission offer to former Piper shareholders. Interest expense declined sharply from the prior year because of the lower level of debt outstanding during 1976 and lower bank interest rates.

Income Taxes

The effective federal and foreign tax rate increased from 44.4% in 1975 to 48.6% in 1976, primarily because of higher taxes on foreign earnings and the impact of foreign currency translation losses and gains on which no tax effect is provided.

Share of Earnings of Piper

Bangor Punta's share of the results of Piper Aircraft Corporation is based on the ownership of 52.2% of the outstanding stock of that company.

Sales of Piper Aircraft Corporation increased 28% over 1975, and Piper's net income tripled to $6,707,000 in 1976 from $2,218,000 in 1975.

The higher earnings reflected a 20% increase in unit aircraft deliveries, improved manufacturing productivity, and the shift in the product mix toward higher margin aircraft.

1975 vs. 1974 Overview

Net income was $9,421,000 in 1975. In 1974, the write-off of intangibles of $19,747,000 and losses from discontinued operations of $16,822,000 had resulted in a net loss of $34,506,000. Primary earnings per share in 1975 reached $1.99 compared with a loss per share of $9.05 in 1974.

All of the operating groups increased their earnings in 1975, with the largest gains coming from manufacturing operations. Lower interest expense and a 57% increase in Bangor Punta's share of the net income of Piper Aircraft Corporation also contributed to the earnings improvement.

Revenues and Profit Contribution

- Weakness in consumer spending and the sale of Starcraft's agriproducts equipment operation and a motorcycle distribution business caused revenues of the Recreational and Leisure Time Group to decline by 32% from 1974. Production and inventory levels were reduced and emphasis was placed on overhead and other cost reduction programs. Operating results for 1974 reflected the impact of losses resulting from the discontinuance of fiberglass motor home production, the termination of a European subsidiary's travel trailer manufacturing operation, and foreign currency exchange losses.

- The Sporting and Law Enforcement Group showed continuing sales and earnings growth in 1975, as increased production was undertaken to meet the strong demand. Profit margins for 1974 were adversely affected by costs incurred in terminating shotgun ammunition production.

- Revenues from the Agricultural Group rose 38% in fiscal 1975. Higher cotton acreage planted in 1974 resulted in increased ginning and mill processing volume, and favorable agricultural prices prevailed during the early part of the crop year.

- Higher sales and earnings in the Industrial Group reflected strong demand from the petroleum industry for heat transfer equipment. Earnings were also improved by the emphasis placed on manufacturing cost control and pricing of new orders in the industrial oven and conveyor lines.

- Other revenues increased in 1975, reflecting gains resulting from the repurchase of both 53A% subordinated bonds due 1992 and 5Za% guaranteed convertible debentures due 1988. Interest income on short-term investments also contributed to the increase.

Corporate Expense and Interest Expense

Corporate general and administrative expenses increased during 1975, principally because of costs incurred in connection with legal and tax matters and the write-off of certain receivables. The use of proceeds from the sale of businesses to reduce indebtedness in the latter part of 1974 and during 1975 caused a sharp decline in 1975 interest expense.

Write-off of Intangibles

The 1974 write-off of intangibles resulted from the determination by Bangor Punta's Board of Directors that $19,747,000 of cost in excess of net assets of companies acquired, relating primarily to domestic recreational and leisure time companies, no longer had continuing value.

Foreseeable economic conditions, increasingly cautious attitudes on the part of consumers, and uncertainties as to the availability and cost of energy sources were the principal factors leading to the Board's decision.

Income Taxes

The 1975 and 1974 income tax provisions reflect foreign income taxed at effective rates in excess of the U.S. rate and the absence of any tax effect for foreign currency translation gains and losses. Investment tax credits reduced the 1975 income tax provision. No tax benefit resulted in 1974 from the write-off of intangibles.

Share of Earnings of Piper

Piper's sales increased in fiscal 1975, despite a decline in the number of units sold, and net income increased. Sales reflected a greater volume in certain of Piper's higher-priced models, and material and other cost increases resulted in the implementation of price increases on a number of occasions during the year.

Piper's operating results for 1974 were adversely affected by higher unit production costs and the effect of price controls, a retroactive pay increase to substantially all of its hourly factory workers as a result of a Federal Pay Board ruling, and payments by Piper of a judgment in a law suit brought by a former distributor.

Earnings for both 1975 and 1974 were determined using the LIFO method of inventory valuation, which was adopted effective October 1, 1973.

Discontinued Operations

In 1974, Bangor Punta sold the two largest operations in the Industrial Group and discontinued the operations of a smaller security services business, resulting in a net loss of $17,394,000. The net operating income of $572,000 from discontinued operations in 1974 reflects the operating results of these businesses prior to their respective dates of disposition.