Notes to Consolidated Financial Statements - BP Corporation FY 1976

Page 1 (32) of 8, Bangor Punta Corporation Notes to Consolidated Financial Statements for Fiscal Years Ended 30 September 1976 and 1975. GGA Image ID # 15d41b48fb

(1) Summary of Significant Accounting Policies:

A. Basis of Consolidation:

The consolidated financial statements include the accounts of Bangor Punta Corporation (the Company) and its subsidiaries (Bangor Punta). except for Prodco Finance Company (Prodco) and Piper Aircraft Corporation (Piper).

The investments in these companies are carried at cost adjusted for Bangor Punta's share of earnings and losses. Condensed statements of Prodco's financial position and Piper's consolidated financial statements are included elsewhere herein. Assets and revenues of foreign subsidiaries aggregated approximately 8% of consolidated assets and consolidated revenues in 1976.

B. Translation of Foreign Currencies:

In 1976. Bangor Punta adopted the method of translating foreign currency financial statements and transactions required by Statement of Financial Accounting Standards No. 8. The effect of this change is principally related to translation of inventories at historical rather than current exchange rates which were previously used. Prior years have not been restated as the effect would not be significant.

C. Inventories:

Through 1975, inventories were valued al the lower of cost (first-in, first-out or average) or market. In 1976, the last-in, lirst-out (LIFO) method of inventory valuation was adopted for substantially all the domestic manufacturing operations Inventories of other operations are stated at the lower of cost (first-in, first-out or average) or market. See Note 6.

D. Properly, Plant and Equipment:

Land is earned at cost and other properties at cost less accumulated depreciation. Major replacements and betterments are capitalized while maintenance and repairs are expensed as incurred Provision for depreciation is based on estimated useful lives of the related assets and is computed generally on the straight-line method.

E. Cost In Excess of Net Assets of Companies Acquired:

Excess costs applicable to acquisitions prior to October

31. 1970 are not being amortized: costs incurred subsequent to that date are being amortized over a forty-year period. The amounts in the accompanying balance sheet are considered to have continuing value over an indefinite period. 'Value." as used herein, is not intended to represent an evaluation of net realizable value upon disposition of an entity.

F. Income Taxes:

The tax effects of timing differences between financial statement and taxable income are provided (credited) as deferred income taxes

Investment tax credits are treated as a reduction of income taxes in the year earned

Consolidated federal income tax returns have been filed for prior years and are expected to be filed in the future.

The undistributed earnings of foreign subsidiaries of approximately $5,500.000 at September 30.1976 are considered to be permanently reinvested. It is Bangor Punta s policy to permanently reinvest earnings of foreign subsidiaries to the extent of their expected operating and expansion requirements, any earnings in excess of such requirements would be available for distribution as dividends U.S. income taxes are provided on expected future distributions of earnings as those earnings are reflected in the consolidated financial statements.

G. Retirement Plans:

Several retirement plans are maintained for the benefit of employees who meet eligibility requirements. Pension costs are funded as accrued, which costs consist of normal cost and past service cost. Charges to operations for deferred profit sharing, union retirement plans and pension plans amounted to $2.525.000 and $2,177.000 for the years ended September 30, 1976 and 1975, respectively. The Company is evaluating the requirements of the Employee Retirement Income Security Act of 1974. The impact. if any. of these requirements on future funding and cost is not presently determinable

(2) Investment in Piper Aircraft Corporation:

At September 30, 1976 Bangor Punta owned 859,191 shares of the outstanding stock of Piper (approximately 52.2%).

The Supreme Court of the United States is reviewing a 1975 decision of the United States Court of Appeals for the Second Circuit, in an action commenced by Chris-Craft Industries. Inc. (Chris-Craft), the owner of 709.450 Piper shares (approximately 43% of the outstanding), growing out of Bangor Punta's acquisition of Piper stock The Court of Appeals held Bangor Punta. David W. Wallace (a Bangor Punta director and officer), Nicolas M. Salgo (a former Bangor Punta director and officer), the First Boston Corporation (First Boston) and three former Piper shareholders (Piper Brothers), jointly and severally liable to Chris-Craft in the amount of $25.793.365, together wth interest thereon trom September 5.1969 (the interest, which accrues at the rate of 6% per annum, amounted to $12.123.000 at September 30,1976).

Further, the Court of Appeals affirmed the November 1974 entry of a decree by a United States Dis-trict Court (the Injunction) which, until November 1979: (i) reinstates Piper's by-laws to those in effect in September 1969, (ii) enjoins Bangor Punta's voting of 231,002 Piper shares (such shares are not to be counted for quorum purposes at shareholders' meetings) (iii) prohibits changes in Piper's by-laws or articles of incorporation (unless agreed to by Bangor Punta and Chris-Craft or ordered by the Court) and (iv) prohibits the merger, dissolution or liquidation of Piper unless ordered by the Court.

Under cumulative voting (used by Piper) no matter how many other shares are voted during the period of the injunction, Chris-Craft's holdings will enable it to elect four directors and Bangor Punta's holdings will enable it to elect at least three directors to Piper's eight member Board Bangor Punta will need significantly fewer votes than Chris-Craft to elect an additional director. Piper's present Board consists of four directors elected by Chris-Craft's shares and four directors elected by Bangor Punta's shares and other shareholders solicited by Bangor Punta.

Pending final disposition by the Supreme Court (which, m the opinion of Bangor Punta's counsel, could occur at any time) the United States Court of Appeals stayed entry of the money judgment but restricted Bangor Punta's ability to: (i) incur additional debt, (ii) grant security interests in its assets. (iii) sell its assets or securities, (iv) pay cash dividends or (v) reduce its net worth.

While each defendant is liable to Chris-Craft for the entire amount of money damages, it any party pays more than its share, it can seek contribution from the other defendants. Special counsel to Bangor Punta have advised that, in their opinion, for purposes of contribution, Messrs. Wallace and Salgo and Bangor Punta should be considered a single defendant and that the basis of liability is such that Messrs. Wallace and Salgo are entitled to indemnification by the Company.

The Company's Board of Directors has voted to indemnify them for any sums they may ultimately have to pay in connection with the Chris-Craft litigation. A portion of any sums so paid would be covered by insurance under a policy which provides coverage for up to an aggregate of $5,000,000, plus a portion of attorneys' fees.

During 1976, Bangor Punta and certain members of the family of the late William T. Piper. Sr. (including the Piper Brothers) settled a lawsuit and Bangor Punta paid $1,749,986 to such former Piper shareholders and issued to them 147,343 shares of its common stock and $2,624,174 in principal amount of its five-year subordinated notes ($1,824,174 in principal amount are secured by a second lien on 667,119 shares of Bangor Punta's Piper

stock).

Pending the final outcome of the Chris-Craft litigation, part of the payment (consisting of $500,000 in cash, $800,000 in principal amount of unsecured notes and 46.000 shares of common stock) has been placed in escrow (the Escrow Fund). Bangor Punta and First Boston have agreed to limit, under certain circumstances, the Piper Brothers' liability to the value of the Escrow Fund.

The Company and First Boston have negotiated an agreement (which requires the consent of Bangor Punta's insurance underwriter) providing for the sharing of any payment to Chris-Craft if Bangor Punta and First Boston are held jointly liable. In any other circumstances this agreement would not take effect.

Should the agreement with First Boston be effective and if the present money judgment is upheld, Bangor Punta and First Boston will share the payment equally; should it be reduced below $38,OCX),000 Bangor Punta's share will be the lesser of 61% of the payment or $19,000,000.

Such agreement also provides, that in the event that they pay Chris-Craft then they will (i) share the Escrow Fund if the Piper Brothers are also liable and (ii) release all claims against each other, and First Boston will not seek contribution from Messrs. Wallace or Salgo.

Should Bangor Punta be required to pay all or a substantial portion of a significant judgment to Chris-Craft, it would have an adverse effect on its financial condition. If Bangor Punta's ultimate net liability were to exceed $15,000,000, then arrangements for additional bank and insurance company financing (see note 8) would be cancelled and a series of defaults could occur under various loan agreements which could result in all outstanding debt becoming due and payable.

It is not possible to determine at this time the ultimate effect the Chris-Craft litigation will have on Bangor Punta's financial condition and its investment in Piper, as it is dependent upon the form of the disposition of the case by the Supreme Court.

Therefore no provision for the effect of the Chris-Craft litigation has been made in Bangor Punta's financial statements. Under existing accounting principles, the effect of any court ordered judgment payable to Chris- Craft would be chargeable, as a prior period adjustment, to retained earnings at September 30, 1969.

The investment in Piper, carried at cost (including costs relating to legal matters arising from the acquisition of Piper shares) adjusted for Bangor Punta's share of Piper's results of operations since October 1. 1969 and reduced by dividends received, amounted to $64,633,000 at September 30,1976. At that date, Bangor Punta's equity in the net assets of Piper was approximately $22,113,000.

When the litigation is finally resolved. Bangor Punta expects that it will be in a position to reevaluate the amount at which its investment in Piper is carried in its balance sheet.

The financial statements of Piper for the years ended September 30. 1976 and 1975 and the qualified report thereon of its independent auditors are included elsewhere herein and are incorporated herein by reference.

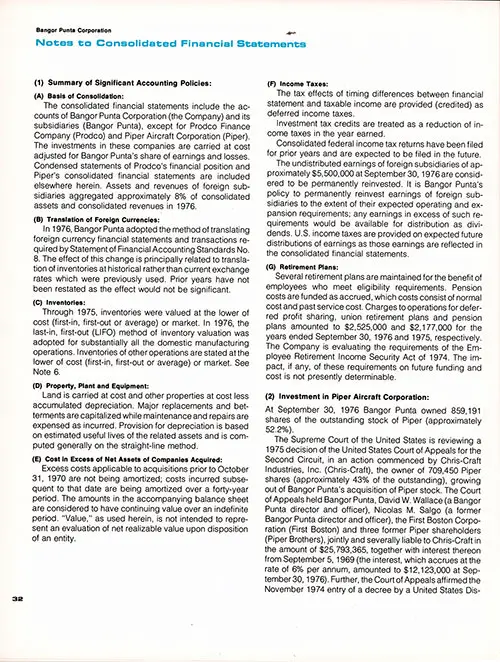

(3) Investment In Prodco:

Condensed statements of financial position of Prodco. wholly-owned by Producers Cotton Oil Company (PCOC) (a wholly-owned subsidiary of the Company), are as follows:

While Prodco has bank loans outstanding. PCOC is obligated to (i) advance Prodco $4,000,000 subordinated to such bank loans: (ii) guarantee a portion of the bank loans ($4,000,000 guaranteed at September 30.1976) and (iii) purchase defaulted grower loans, if any. up to $1,000,000.

4. Investment in Lone Star Industries, Inc.:

During 1976 Bangor Punta acquired, as an investment, 150,000 shares of Lone Star Industries, Inc. (Lone Star) common stock for $2,553,900 ($17.026 per share, the average of the mean market price for such stock during the months of March through June 1976) and nine options to acquire, also for cash, an additional 950,000 shares of Lone Star stock over a period of years ending in 1985.

The first 400,000 shares subject to option have a purchase price of $17,026 per share and the remaining 550.000 shares will have a price of $1 per share less than the average market price computed at the time of purchase but not less than $19,026 per share.

The 1,100,000 Lone Star shares, which aggregate slightly less than 10% of the outstanding Lone Star stock, are being acquired from Mr. James E. Stewart and entities related to him.

Mr. Stewart is Chairman of the Board of Directors of Lone Star and also Vice Chairman of the Board of Directors of Bangor Punta, Chairman of its Executive Committee and a substantial stockholder.

This transaction will be submitted to Bangor Punta's stockholders for approval at the next stockholders meeting. If approval is not obtained, the options will be cancelled. Bangor Punta will return the 150,000 shares and the purchase price will be repaid to Bangor Punta.

5. Dispositions:

During 1976. Bangor Punta realized a gain of $1,443,000 from the sale of agricultural land and a loss of $1,530,000 on its investment in a terminated joint agricultural venture. Such amounts are included in "Other income, net."

During 1975, the agriproducts operation of Starcraft and a motorcycle distribution business were sold for a gain of approximately $1,000,000 and a loss of approximately $1,100,000, respectively (included in "Other income, net"). Sales of these operations, included in consolidated revenues, totaled $5,500,000 in 1975.

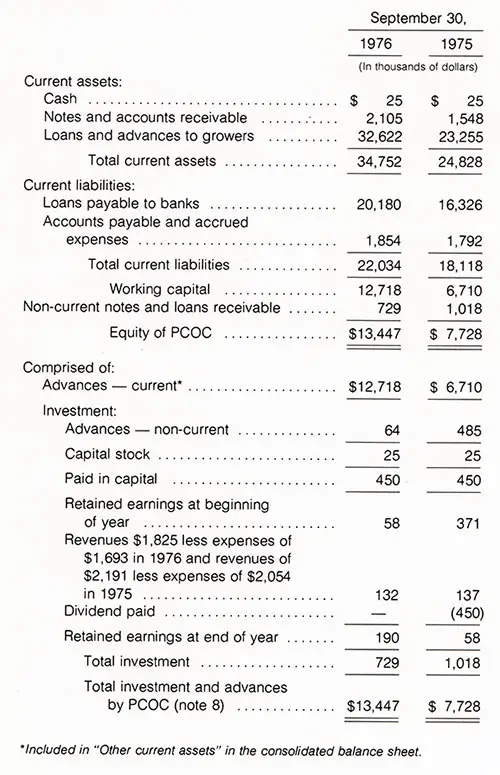

(6) Change in the Method of Inventory Valuation:

Effective October 1,1975. Bangor Punta adopted, for substantially all of its domestic manufacturing operations, the dollar value last-in, first-out (LIFO) method of inventory valuation. This change was made to provide a closer matching of current costs against current revenues in periods of inflation (which Bangor Punta expects to continue to affect its inventories).

The effect of the change was to reduce inventories at September 30. 1976 by approximately $1,933,000 and net income for 1976 by approximately $1,005.000 ($.23 per share) from what would have been reported under the inventory accounting method used prior to October 1,1975.

It is not practical to restate earlier years to reflect the LIFO method and, therefore, neither the cumulative effect of the change on prior years nor the pro forma results for such years are presented.

A summary of inventories by accounting methods used follows:

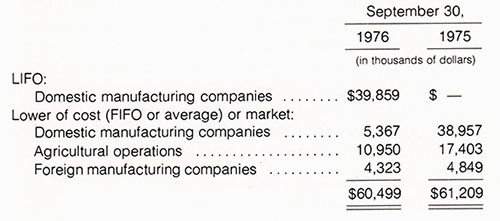

(7) Properties and Depreciation:

Properties and accumulated depreciation consisted of the following:

The rates used in computing depreciation are as follows: Buildings and site improvements 2 1/2% to 10%; machinery and equipment 5 1/2% to 33 1/3%: and leasehold improvements over the term of the lease or estimated useful life of the improvements, whichever is shorter.

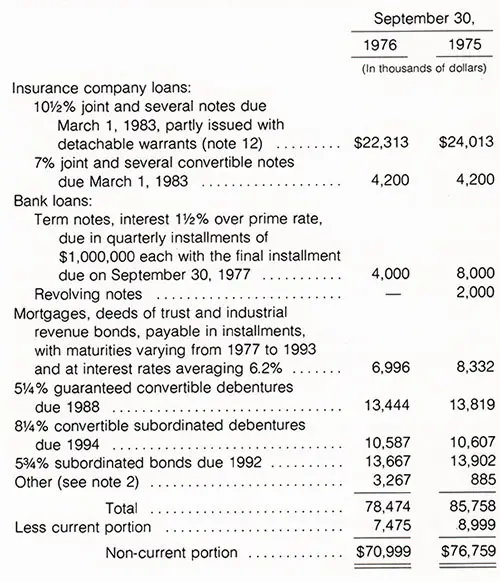

(8) Long-Term Debt:

Long-term debt is summarized as follows:

Insurance company and bank loans:

The average rate of interest on the joint and several notes due March 1, 1983 was 7.98% at September 30, 1975. Concurrent with the commitment described below, the rate was increased to 10'/2% effective August 25, 1976. These notes are presently repayable in annual installments of $1.700.000 in 1977 and $2.230.000 in 1978-1982 with the balance of $9,463,000 due on March 1, 1983.

The 7% joint and several convertible notes due March 1, 1983 are convertible into common stock at $27.20, subject to anti-dilution adjustments.

An informal arrangement (without contractual withdrawal restrictions) exists with the lending banks for the maintenance of compensating balances equivalent to 15% of average bank borrowings.

The Company and Bangor Punta Operations. Inc., (BPO). a wholly-owned and the principal operating subsidiary of the Company, are jointly and severally liable for the insurance company loans. The bank loans (obligations of BPO) are guaranteed by the Company.

Under the insurance company and bank loan agreements, the Company has (i) pledged the capital stock of BPO (ii) granted a security interest in the capital stock of PCOC (subject to the prior pledge of such stock described below) and (iii) agreed, upon the occurrence of an event of default and if requested by the lenders, to form separate corporations out of one or more operating units of BPO and to pledge the stock of any corporation so formed. Additionally, BPO has pledged, as security for the loans, 667,119 shares of Piper common stock.

The loan agreements provide for, among other things, limitations on indebtedness and capital expenditures; the maintenance of minimum working capital; and prepayments on the loans outstanding with a portion of the proceeds. as defined, received from the sale of specified assets or capital stock of subsidiaries.

The banks have the right to call outstanding loans if there are substantial changes in the composition of the Board of Directors or principal officers of the Company.

Bangor Punta has obtained a commitment, expiring December 31,1977, from its insurance company lender for an additional term loan of $10,000,(XX).

The commitment provides for extension of maturity of the existing 101/2% joint and several notes with repayment of the aggregate indebtedness. including the additional borrowing, in approximately equal annual installments through September 1, 1988 Borrowing of these funds will be contingent upon both the availability of a $12.000,000 bank credit and a final net liability for Bangor Punta in the Chris-Craft litigation, after allowing for contribution and insurance recoveries, of not more than $15,000,000.

Bangor Punta has also obtained a $ 12,000,000 revolving credit from certain banks, which will be reduced to $10,000,000 at April 30,1977, $7,000,000 at June 30, 1977 with repayment of the balance by September 30,1977. This credit will be cancelled if the final net liability of Bangor Punta to Chris-Craft exceeds $15,000,000.

5 1/4% guaranteed convertible debentures:

The 5 1/4% guaranteed convertible debentures due July 1, 1988 are unsecured direct obligations of Bangor Punta International Capital Company (BPICC), a wholly-owned subsidiary of BPO, are guaranteed jointly and severally by the Company and BPO, and are convertible into the Company's common stock at $54.25 per share, subject to adjustment.

Commencing 1979, the debentures will be subject to redemption through an annual sinking fund in principal amounts equal to 10% of the debentures outstanding on April 30,1979. At the option of BPICC, subject to certain restrictions, the debentures may be redeemed in principal amounts of not less than $1,000,000. In the event that interest paid to the debenture holders becomes subject to United States taxation. BPICC will reimburse the debenture holders for such amounts or may call the debentures for redemption. Gains of $203,000 and $262,000 in 1976 and 1975, respectively, on debentures repurchased in the open market to partially satisfy future sinking fund requirements are included in "Other income, net."

8 1/4% convertible subordinated debentures:

The 8 1/4% convertible subordinated debentures, convertible into common stock at $50.77 per share, subject to anti-dilution provisions, are entitled to an annual sinking fund commencing July 1, 1980 of amounts equal to the following percentages of outstanding debentures: 1980-1984, 4%; 1985-1989, 7%; 1990-1993, 9%. The debentures are redeemable at the option of the Company.

5 3/4% subordinated bonds:

The 5 3/4% subordinated bonds are secured by the pledge of all of the common stock of PCOC. A mortgage of certain real estate interests (subject to existing liens) owned by a subsidiary of PCOC may be substituted for the pledged shares.

Deficiencies after realization on the pledged security are subordinated to all existing and future senior indebtedness, as defined.

The bonds are entitled to a $175,000 annual purchase fund through November 15, 1977 and, commencing on November 15, 1978, to an annual sinking fund of approximately $780,000 which may be reduced to no less than $175,000 by limited application of bonds acquired.

The Company expects that the 1978 to 1981 sinking fund payments will be no more than $ 175.000 per year. At the option of the Company, the bonds are redeemable subject to certain restrictions.

Gains of $77,000 and $205,000 in 1976 and 1975, respectively, on bonds repurchased in the open market to partially satisfy purchase and sinking fund requirements are included in "Other income, net."

Maturities and other matters:

Maturities of long-term debt in the next five years are as follows: 1977. $7.475,000; 1978. $3.884.000; 1979. $4,207,000; 1980, $5,126,000; and 1981, $5,399.000 Farm lands of PCOC are substantially pledged under deeds of trust and mortgages.

See note 11 for information concerning restrictions on dividend payments.

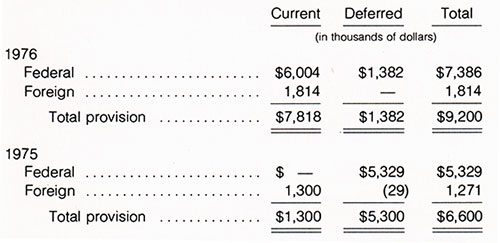

(9) Federal and Foreign Income Taxes:

The provision for income taxes is as follows:

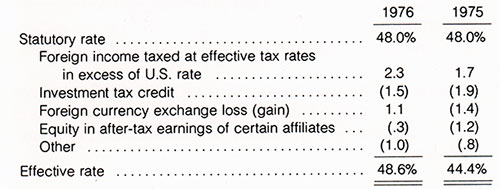

The 1976 and 1975 tax provisions (before Bangor Punta's share in net income of Piper) result in effective tax rates of 48.6% and 44.4%, respectively. A reconciliation to the federal tax rate of 48% follows:

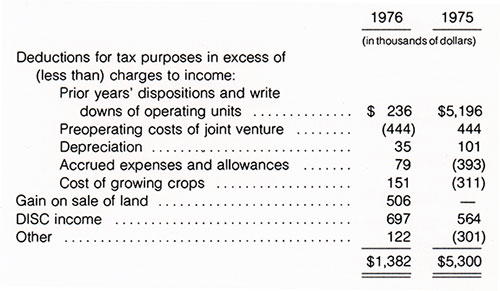

Deferred income tax expense results from timing differences in the recognition of revenues and expenses for tax and financial reporting purposes. These differences and the related deferred tax effects are as follows:

The Company's tax returns for 1968 and subsequent years are subject to adjustment by taxing authorities. A revenue agent's report for the years 1968 through 1971, which the Company is protesting, indicates a potential deficiency, excluding interest, of approximately $1,000,000. The Company believes that taxes which may be payable for open years are sufficiently provided for in its accounts.

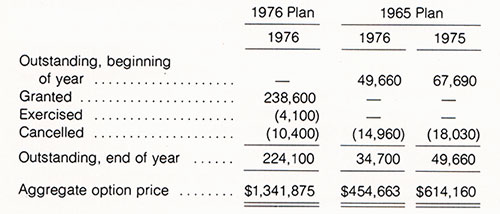

(10) Stock Options:

The Company's 1965 Stock Option Plan terminated on January 18,1975 with certain unexpired options remaining outstanding. A 1976 Stock Option Plan, adopted by the Board of Directors in January 1976 and approved by the shareholders on March 2,1976, authorizes options for up to 250,000 shares of common stock until January 26, 1986 at an option price to be no less than the fair market value of the common stock at the time each option is granted.

The 1976 Plan provides for both qualified and non-qualified stock options with options exercisable not later than (i) 5 years from the date of grant (but in no case later than May 20, 1981) for qualified options and (ii) 10 years from the date of grant for non-qualified options.

A summary of the changes in outstanding options for both plans follows:

(11) Capital Stock:

The $1.25 convertible preference stock, $1 par value, is entitled to: (i) cumulative dividends at the annual rate of $1.25, (ii) $25.25 upon redemption, (iii) $25 per share plus accrued dividends upon involuntary liquidation. Such stock is convertible at the rate of one share of common stock for each share of preference stock.

The $2.00 convertible preference stock — Series C, $1 par value, is entitled to: (i) cumulative dividends at the annual rate of $2.00, (ii) $50.00 per share plus accrued dividends upon involuntary liquidation.

Such stock is convertible at the rate of 1.37 shares of common stock for each share of such preference stock, subject to adjustment, and may be redeemed at $51.00 per share to July 30,1977, and at $50.00 per share thereafter plus accrued dividends.

The preference in involuntary liquidation exceeds the par value of the outstanding $ 1.25 convertible preference stock and the $2.00 convertible preference stock Series C by $31,464,407 (excluding dividends in arrears) at September 30,1976. In the opinion of counsel, there are no restrictions upon surplus by reason of such differences.

Certain of Bangor Punta's debt agreements contain restrictions on the payment of cash dividends and the redemption of stock. Under the most restrictive negative covenant, no retained earnings have been available for the payment of dividends since September 30,1973 and waivers of this requirement were obtained to permit the payment of preference stock dividends through December 15,1974.

Further, until the Chris-Craft litigation is resolved, the insurance and bank loan agreements prohibit the payment of dividends. Commencing December 16, 1974, no amount was available under the Indenture relating to the 8,/4% convertible subordinated debentures due 1994 for the payment of dividends, including dividends on preference stock outstanding, and since April 1975 the Court order referred to in note 2 has also prohibited the payment of dividends.

As a consequence, dividends on the preference stock have not been paid since December 15,1974, resulting in a total dividend arrearage of $2,351,604 as of September 30, 1976. In November 1976 the Indenture relating to the 81/4% convertible subordinated debentures due 1994 was amended to permit the payment of dividends, however, the other restrictions on dividend payments remain in effect.

Dividends on the preference stock are cumulative. Should dividends for six or more quarterly periods (whether or not consecutive) not be paid, as is presently the case, the holders of such stock become entitled, voting as a class, to elect two directors to the Board of Directors.

(12) Common Stock Purchase Warrants:

Series A warrants and Series B warrants expiring March 1, 1983, were issued to the purchaser of the 10V2% joint and several notes. At September 30, 1976, 120,292 shares of common stock were reserved for exercise at an exercise price of $9.56 per share, subject to adjustment.

Simultaneously with the execution of the purchase contract contemplated by the commitment described in note 8, the expiration date of such warrants will be extended to September 1, 1988.

Series C warrants (1,943,706 outstanding at September 30,1976) entitle the holder to purchase 2,111,889 shares of common stock until March 31, 1981 at $50.62 per share, subject to adjustment.

(13) Commitments and Contingent Liabilities:

Settlement of outstanding litigation other than the lawsuit described in note 2 above, in the opinion of the Senior Vice President and General Counsel, based in part on concurring opinions of outside counsel, should not have a material adverse effect on Bangor Punta's financial position.

Real property rentals, for the years ended September 30, 1976 and 1975 aggregated approximately $2,050,000 and $2,750,000, respectively. For 1976, approximately $1,000,000 were contingent rentals based upon certain cotton gin operating earnings and on crop sharing arrangements.

Because of their variable nature, it is not possible to forecast future contingent rentals. The approximate minimum rental commitments (net of annual sublease income of approximately $200,000 per year through 1984) under non-cancellable leases are as follows: 1977, $600,000; 1978, $500,000; 1979, $400,000; 1980, $400,000; 1981, $300,000; 1982 through 1986, $1,000,000; 1987 through 1991, $900,000; 1992 through 1996, $800,000 and thereafter, $600,000. Certain leases provide for the payment of real estate taxes and other expenses.

Personal property rentals for the years ended September 30, 1976 and 1975 aggregated approximately $2,900,000 for each year, substantially all of which were for delivery and harvesting equipment leased for four to six-year periods. Delivery equipment rentals are payable on a per- mile basis with minimum mileage guarantees.

The approximate minimum rental commitments, excluding maintenance, fuel and operating expenses, payable under present personal property leases are as follows: 1977, $1,700,000; 1978, $1,400,000; 1979, $1,000,000; 1980, $800,000 and 1981, $300,000.