Piper Aircraft Corporation Financial Statements and Accompanying Notes for the Fiscal Years Ended 30 September 1976 and 1975

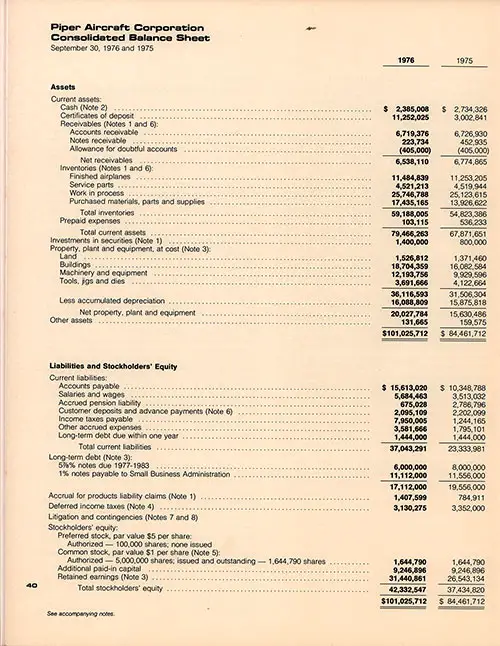

Piper Aircraft Corporation Colidated Balance Sheet for the Fiscal Years Ended 30 September 1976 and 1975. GGA Image ID # 15d4ae41b7

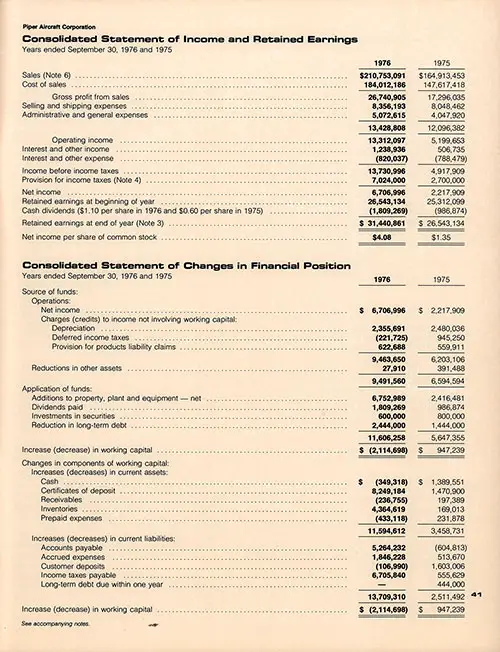

Piper Aircraft Corporation Consolidated Statement of Income and Retained Earnings and Consolidated Statement of Changes in Financial Postion for the Fiscal Years Ended 30 September 1976 and 1975. GGA Image ID # 15d4e2ef96

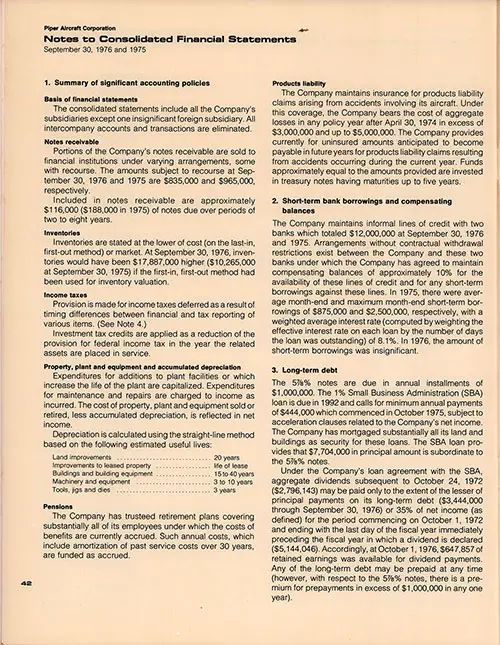

Piper Aircraft Corporation, First Page of 3 of Notes to Consolidated Financial Statements for the Fiscal Years Ended 30 September 1976 and 1975. GGA Image ID # 15d4f206ca

1. Summary of significant accounting policies

Basis of financial statements

The consolidated statements include all the Company's subsidiaries except one insignificant foreign subsidiary. All intercompany accounts and transactions are eliminated.

Notes receivable

Portions of the Company's notes receivable are sold to financial institutions under varying arrangements, some with recourse. The amounts subject to recourse at September 30, 1976 and 1975 are $835,000 and $965,000, respectively.

Included in notes receivable are approximately $116,000 ($188,000 in 1975) of notes due over periods of two to eight years.

Inventories

Inventories are stated at the lower of cost (on the last-in, first-out method) or market. At September 30, 1976, inventories would have been $17,887,000 higher ($10,265,000 at September 30. 1975) if the first-in, first-out method had been used for inventory valuation.

Income taxes

Provision is made for income taxes deferred as a result of timing differences between financial and tax reporting of various items. (See Note 4.)

Investment tax credits are applied as a reduction of the provision for federal income tax in the year the related assets are placed in service.

Property, plant and equipment and accumulated depreciation

Expenditures for additions to plant facilities or which increase the life of the plant are capitalized. Expenditures for maintenance and repairs are charged to income as incurred. The cost of property, plant and equipment sold or retired, less accumulated depreciation, is reflected in net income.

Depreciation is calculated using the straight-line method based on the following estimated useful lives:

- Land improvements 20 years

- Improvements to leased property life of lease

- Buildings and building equipment 15 to 40 years

- Machinery and equipment 3 to 10 years

- Tools, jigs and dies 3 years

Pensions

The Company has trusteed retirement plans covering substantially all of its employees under which the costs of benefits are currently accrued. Such annual costs, which include amortization of past service costs over 30 years, are funded as accrued.

Products liability

The Company maintains insurance for products liability claims arising from accidents involving its aircraft. Under this coverage, the Company bears the cost of aggregate losses in any policy year after April 30, 1974 in excess of $3,000,000 and up to $5,000,000. The Company provides currently for uninsured amounts anticipated to become payable in future years for products liability claims resulting from accidents occurring during the current year. Funds approximately equal to the amounts provided are invested in treasury notes having maturities up to five years.

2. Short-term bank borrowings and compensating balances

The Company maintains informal lines of credit with two banks which totaled $12,000,000 at September 30, 1976 and 1975. Arrangements without contractual withdrawal restrictions exist between the Company and these two banks under which the Company has agreed to maintain compensating balances of approximately 10% for the availability of these lines of credit and for any short-term borrowings against these lines. In 1975, there were average month-end and maximum month-end short-term borrowings of $875,000 and $2,500,000, respectively, with a weighted average interest rate (computed by weighting the effective interest rate on each loan by the number of days the loan was outstanding) of 8.1%. In 1976, the amount of short-term borrowings was insignificant.

3. Long-term debt

The 5 7/8% notes are due in annual installments of $1,000,000. The 1% Small Business Administration (SBA) loan is due in 1992 and calls for minimum annual payments of $444,000 which commenced in October 1975, subject to acceleration clauses related to the Company's net income. The Company has mortgaged substantially all its land and buildings as security for these loans. The SBA loan provides that $7,704,000 in principal amount is subordinate to the5 7/8% notes.

Under the Company's loan agreement with the SBA, aggregate dividends subsequent to October 24. 1972 ($2,796,143) may be paid only to the extent of the lesser of principal payments on its long-term debt ($3,444,000 through September 30, 1976) or 35% of net income (as defined) for the period commencing on October 1, 1972 and ending with the last day of the fiscal year immediately preceding the fiscal year in which a dividend is declared ($5,144,046). Accordingly, at October 1,1976, $647,857 of retained earnings was available for dividend payments. Any of the long-term debt may be prepaid at any time (however, with respect to the 5 7/8% notes, there is a premium for prepayments in excess of $1,000,000 in any one year).

The annual aggregate long-term debt maturing during each of the next five years (subject to adjustments which may arise as a result of the acceleration clauses in the SBA loan agreement) is $1,444,000.

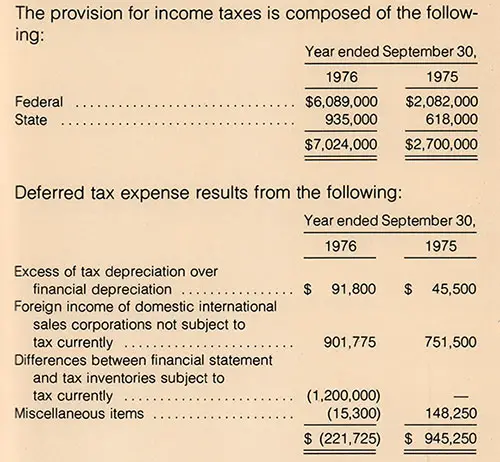

4. Income taxes

The provision for income taxes is composed of the following:

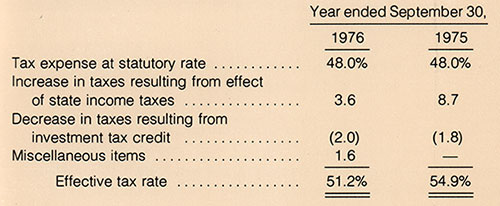

Total tax expense amounted to $7,024,000 for the year ended September 30, 1976 ($2,700,000 in 1975) or an effective rate of 51.2% (54.9% in 1975) as compared with the U.S. statutory federal income tax rate of 48%. Components of the effective tax rate, expressed as a percentage of pretax income, are as follows:

Provisions for federal income taxes for 1976 and 1975 have been reduced by investment tax credits of $272,860 and $89,626, respectively.

5. Employee benefit plans

The cost of all pension plans was $2,805,000 for the year ended September 30, 1976, compared to $3,000,000 for the year ended September 30, 1975. Unfunded past service cost of all plans at September 30.1976 approximated $8,825,645 ($17,479,000 at September 30. 1975); the actuarially computed value of vested benefits does not exceed the pension funds and balance sheet accruals. The reduction in unfunded past service cost during the year was primarily the result of a change during fiscal 1976 in the actuarial cost method used in computing pension cost for one of the Company's retirement plans. This change had an insignificant effect on net income for the year.

Approximately $625,000 was accrued under salaried employee incentive compensation plans in 1976. Approximately $3,000 was earned in 1975.

At September 30, 1976, 38,800 shares of common stock were reserved under the Company's stock option plan; no options were outstanding at that date. No options were granted or exercised during 1976 and 1975. (See Note 7.)

6. Foreign operations

Sales to distributors and dealers located outside the United States accounted for approximately 34% of sales for the year ended September 30. 1976 (35% for the year ended September 30, 1975); at September 30, 1976 $5,518,000 of accounts and notes receivable were due from such persons ($5,124,000 at September 30, 1975). Inventories outside the United States (principally in Switzerland) approximated $294,000 at September 30, 1976 ($968,000 at September 30, 1975). Deposits and advance payments from foreign customers amounted to $2,060,000 and $2,152,000 at September 30,1976 and 1975, respectively.

7. Litigation

Bangor Punta Corporation currently holds approximately 52% (859,191 shares) and Chris-Craft Industries. Inc. approximately 43% (709,450 shares) of the Company's common stock.

A 1974 United States District Court's decree, entered in a 1969 action brought by Chris-Craft, (i) enjoins until November 1979 (a) Bangor Punta's voting, and (b) the counting for quorum purposes, of 231,002 shares of the Company's common stock, (ii) orders, for the period of the injunction, the reinstatement of the Company's By-Laws to those in effect in September 1969, fixing the number of directors of the Company at eight, (iii) prohibits changes in such reinstated By-Laws and the Company's Articles of Incorporation unless agreed to by Bangor Punta and Chris-Craft or ordered by the Court and (iv) prohibits changes in the Company's outstanding voting stock or the merger, dissolution or liquidation of the Company until November 1979, unless ordered by the Court.

Under cumulative voting, used to elect directors of the Company, the number of shares needed to elect a director depends on the number of directors to be elected and the number of shares voted in the election.

Chris-Craft's present holdings of the Company's stock enable it to elect four directors and Bangor Punta's present holdings enable it to elect three directors to an eight-man board during the period of the injunction, no matter how many of the publicly held shares are voted.

If no more than 75,786 of the publicly held shares should be voted and even if all such shares should be voted for a Chris-Craft nominee, Bangor Punta will have sufficient votes to elect the eighth director.

The maximum number of other shares which would be needed to elect a fourth Bangor Punta designee would be 162, which would be needed only if all 76,149 publicly held shares should be voted.

In February 1976, an eight-man Board was elected (comprising four persons nominated by Chris-Craft and four persons nominated by Bangor Punta) by shareholders. The District Court has retained jurisdiction to modify its decree should that appear necessary or appropriate.

The United States Supreme Court has decided to review the decisions in the action brought by Chris-Craft and a decision by that Court could be issued at any time.

The Company is a defendant in an action brought in a United States District Court by a former dealer purporting to be a class action on behalf of certain of the Company's dealers and claiming treble damages of at least $150,000,000 based on alleged violations of federal antitrust laws.

The District Court has dismissed the class action allegations of this case and the plaintiff is attempting to appeal that dismissal. I n the opinion of the Company's Vice President- General Counsel, based upon the opinion of special counsel, the ultimate disposition of this action will not have a material adverse effect on the Company's financial position or results of operations.

8. Contingencies

The Company is a defendant in a number of lawsuits involving products liability claims of a material amount, some involving claims for punitive or exemplary damages, and the time period for filing claims with respect to products sold prior to September 30, 1976 has not expired.

Management periodically reviews the Company's insurance coverage for products liability claims and increases such coverage at times and in amounts considered appropriate. Note 1, Products liability, explains the amounts the Company will pay directly to claimants after April 30, 1974 in conjunction with its current products liability insurance coverage.

In the opinion of management, all liability which may result from current claims for damages is adequately covered by insurance or has been accrued for by the Company.

It is possible that in certain circumstances such insurance and accrued liabilities could prove to be inadequate, thus requiring additional payments directly from the Company.

It cannot be determined at this time whether the Company will be required to make any such payments in the future, and, if so required, whether such amounts will be material.

Report of Certified Public Accountants

The Board of Directors and Shareholders Piper Aircraft Corporation

We have examined the accompanying consolidated balance sheet of Piper Aircraft Corporation at September 30, 1976 and 1975. and the related consolidated statements of income and retained earnings and changes in financial position for the years then ended. Our examination was made in accordance with generally accepted auditing standards, and accordingly included such tests of the accounting records and such other auditing procedures as we considered necessary in the circumstances.

As discussed more fully in Note 8 to the financial statements, it is possible that in certain circumstances the Company's insurance coverage and accrued liabilities could prove to be inadequate to cover claims involving products liability for products sold prior to September 30.1976. It cannot be determined at this time whether the Company will be required to make payments directly to claimants in the future for amounts not covered by insurance and not accrued for, and if so required, whether such amounts will be material.

In our opinion, subject to the effects of such adjustments, if any, as might have been required had the outcome of the uncertainty referred to in the preceding paragraph been known, the financial statements mentioned above present fairly the consolidated financial position of Piper Aircraft Corporation at September 30, 1976. and 1975 and the consolidated results of operations and changes in financial position for the years then ended, in conformity with generally accepted accounting principles applied on a consistent basis during the period.

ARTHUR YOUNG & COMPANY

New York, N.Y.

November 16. 1976