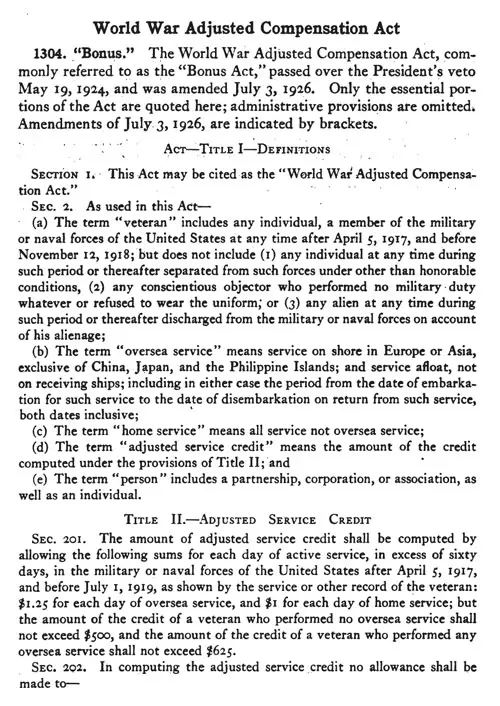

World War Adjusted Compensation Act

1304. "Bonus." The World War Adjusted Compensation Act, commonly referred to as the "Bonus Act," passed over the President's veto May 19, 1924, and was amended July 3, 1926. Only the essential portions of the Act are quoted here; administrative provisions are omitted. Amendments of July. 3, 1926, are indicated by brackets.

ACT-TITLE I—DEFINITIONS

SECTION 1. This Act may be cited as the "World War' Adjusted Compensation Act."

SEC. 2. As used in this Act—

- (a) The term "veteran" includes any individual, a member of the military or naval forces of the United States at any time after April 5, 1917, and before November 12, 1918; but does not include

- (1) any individual at any rime during such period or thereafter separated from such forces under other than honorable conditions,

- (2) any conscientious objector who performed no military duty whatever or refused to wear the uniform; or

- (3) any alien at any time during such period or thereafter discharged from the military or naval forces on account of his alienage;

- (b) The term "oversea service" means service on shore in Europe or Asia, exclusive of China, Japan, and the Philippine Islands; and service afloat, not on receiving ships; including in either case the period from the date of embarkation for such service to the date of disembarkation on return from such service, both dates inclusive;

- (c) The term "home service" means all service not oversea service;

- (d) The term "adjusted service credit" means the amount of the credit computed under the provisions of Title II; and

- (e) The term "person" includes a partnership, corporation, or association, as well as an individual.

TITLE II—ADJUSTED SERVICE CREDIT

SEC. 201. The amount of adjusted service credit shall be computed by allowing the following sums for each day of active service, in excess of sixty days, in the military or naval forces of the United States after April 5, 1917, and before July I, 1919, as shown by the service or other record of the veteran: $1.25 for each day of oversea service, and $1 for each day of home service; but the amount of the credit of a veteran who performed no oversea service shall not exceed $500, and the amount of the credit of a veteran who performed any oversea service shall not exceed $625.

SEC. 202. In computing the adjusted service credit no allowance shall be made to-

- (a) Any commissioned officer above the grade of captain in the Army or Marine Corps, lieutenant in the Navy, first lieutenant or first lieutenant of engineers in the Coast Guard, or passed assistant surgeon in the Public Health Service, or having the pay and allowances, if not the rank, of any officer superior in rank to any of such grades—in each case for the period of service as such;

- (b) Any individual holding a permanent or provisional commission or permanent or acting warrant in any branch of the military or naval forces, or (while holding such commission or warrant) serving under a temporary commission in a higher grade—in each case for the period of service under such commission or warrant or in such higher grade after the accrual of the right to pay thereunder. This subdivision shall not apply to any noncommissioned officer;

- (c) Any civilian officer or employee of any branch of the military or naval forces, contract surgeon, cadet of the United States Military Academy, midshipman, cadet or cadet engineer of the Coast Guard, member of the Reserve Officers' Training Corps, member of the Students' Army Training Corps (except an enlisted man detailed thereto), Philippine Scout, member of the Philippine Guard, member of the Philippine Constabulary, member of the National Guard of Hawaii, member of the insular force of the Navy, member of the Samoan native guard and band of the Navy, or Indian Scout—in each case for the period of service as such;

- (d) Any individual entering the military or naval forces after November xi, 1918—for any period after such entrance;

- (e) Any commissioned or warrant officer performing home service not with troops and receiving commutation of quarters or of subsistence—for the period of such service;

- (f) Any member of the Public Health Service—for any period during which he was not detailed for duty with the Army or the Navy;

- (g) Any individual granted a farm or industrial furlough—for the period of such furlough;

- (h) Any individual detailed for work on roads or other construction or repair work—for the period during which his pay was equalized to conform to the compensation paid to civilian employees in the same or like employment, pursuant to the provisions of section 9 of the Act entitled "An Act making appropriations for the service of the Post Office Department for the fiscal year ending June 30, 1920, and for other purposes," approved February 28, 1919; or

- (i) Any individual who was discharged or otherwise released from the draft—for the pei iod of service terminating with such discharge or release.

SEC. 203.

- (a) The periods referred to in subdivision (e) of section 202 may be included in the case of any individual if and to the extent that the Secretary of War and the Secretary of the Navy jointly find that such service subjected such individual to exceptional hazard. A full statement of all action under this subdivision shall be included in the reports of the Secretary of War and the Secretary of the Navy required by section 307.

- (b) In computing the credit to any veteran under this title effect shall be given to all subdivisions of section 202 which are applicable.

- (c) If part of the service is oversea service and part is home service, the home service shall first be used in computing the sixty days' period referred to in section 201.

- (d) For the purpose of computing the sixty days' period referred to in section 201, any period of service after April 5, 1917, and before July I, 1919, in the military or naval forces in any capacity may be included, notwithstanding allowance of credit for such period, or a part thereof, is prohibited under the provisions of section 202, except that the periods referred to in subdivions (b), (c), and (d) of that section shall not be included.

- (e) For the purposes of section 201, in the case of members of the National Guard of the National Guard Reserve called into service by the proclamation of the President dated July 3, 1917, the time of service between the date of call into the service as specified in such proclamation and August 5, 1917, both dates inclusive, shall be deemed to be active service in the military or naval forces of the United States.

TITLE III.—GENERAL PROVISIONS BENEFITS GRANTED VETERANS

SEC. 301. Each veteran shall be entitled:

- (1) To receive "adjusted service pay" as provided in Title IV, if the amount of his adjusted service credit is $50 or less;

- (2) To receive an "adjusted service certificate" as provided in Title V, if the amount of his adjusted service credit is more than $50.

APPLICATION BY VETERAN

SEC. 302.

- (a) A veteran may receive the benefits to which he is entitled by application claiming the benefits of this Act, filed with the Secretary of War if he is serving in, or his last service was with, the military forces; or filed with the Secretary of the Navy, if he is serving in, or his last service was with, the naval forces.

- (b) Such application shall be made and filed on or before January (2, 1930,] (1) personally by the veteran, or (2) in case physical or mental incapacity prevents the making of filing of a personal application, then by such representative of the veteran and in such manner as may be by regulations prescribed. An application made by a person other than the representative authorized by any such regulation, or not filed on or before January [2, 1930,] shall be held void.

If the veteran dies after the application is made and before it is filed it may be filed by any person: Provided, however, that if the veteran died between May 19, 1924, and July I, 192.4, without making the application, leaving a widow surviving him, the application may be made by the widow and shall be valid with the same force and effect in every respect as if the application had been made by the veteran. - (c) If the veteran dies after the application is made, it shall be valid if the Secretary of War or the Secretary of the Navy, as the case may be, finds that it bears the bona fide signature of the applicant, discloses an intention to claim the benefits of this Act on behalf of the veteran, and is filed on or before January [2, 1930,] whether or not the veteran is alive at the time it is filed.

If the veteran dies and payments are made to his dependents under Title VI, and thereafter a valid application is filed under this section, then if the adjusted service credit of the veteran is more than ko, payment shall be made in accordance with Title V, less any amounts already paid under Title VI. - (d) The Secretary of War and the Secretary of the Navy shall jointly make any regulations necessary to the efficient administration of the provisions of this section.

TRANSMITTAL OF APPLICATION

SEC. 303.

- (a) As soon as practicable after the receipt of a valid application the Secretary of War or the Secretary of the Navy, as the case may be, shall transmit to the Director of the United States Veterans Bureau (hereafter in this Act referred to as the Director) the application and a certificate setting forth—

- (1) That a valid application has been received;

- (2) That the applicant is a veteran;

- (3) His name and address;

- (4) The date and place of his birth; and

- (5) The amount of his adjusted service credit. (Omission.)

- (6) Upon receipt of such certificate the Director shall proceed to extend to the veteran the benefits provided for in Title IV or V.

SECS. 304-7. Administrtive provisions.

SEC. 308.

- (a) No sum payable under this Act to a veteran or his dependents, or to his estate, or to any beneficiary named under Title V, no adjusted service certificate, and no proceeds of any loan made on such certificate, shall be subject to attachment, levy, or seizure under any legal or equitable process, or to National or State taxation, and no deductions on account of any indebtedness of the veteran to the United States shall be made from the adjusted service credit or from any amounts due under this Act.

- (b) As used in this section the term "original credit" means the amount of the adjusted service credit computed under the World War Adjusted Cornpensation Act before its amendment by this Act, less amounts deducted on account of any indebtedness of the veteran to the United States; and the term "new credit" means the amount of the adjusted service credit computed under such Act as amended by this Act, without such deduction.

- (c) If the veteran is alive at the time of the enactment of this Act and the benefits of the World War Adjusted Compensation Act have been extended to him, then any excess of the new credit over the original credit shall be considered as if it were a separate adjusted service credit and the benefits of such Act shall be extended in respect thereof according to the terms of such Act as amended by this Act.

- (d) If the veteran has died before the enactment of this Act and before making application under section 302 of the World War Adjusted Compensation Act, then if any part of the original credit has been paid to the dependents of the veteran, any remaining part shall be paid as provided in Title VI of such Act as amended by this Act, and any excess of the new credit over the original credit shall be paid in cash in a lump sum to the dependents as provided in Title VI of such Act as amended by this Act.

- (e) If the veteran has died before the enactment of this Act after having made application, then—

- (1) If the original credit was not over $50 and the new credit is not over $50 payment shall be made as provided in subdivision (d).

- (2) If the original credit was not over $50 and the new credit is over $50 then the face value of an adjusted service certificate computed on the basis of the new credit shall be paid to the beneficiary named, or, if the beneficiary died before the veteran and no new beneficiary was named or if no beneficiary was named in the application, then to the estate of the veteran. If in any such case any payments have already been made to the veteran or his dependents, the amount of such payments shall be deducted from the face value of the adjusted service certificate.

- (3) If the original credit was over $50 then the face value of an adjusted service certificate computed on the basis of the excess of the new crdit over the original credit shall be paid as provided in paragraph (2) of this subdivision.

- (f) Wherever under this Act or the World War Adjusted Compensation Act it is provided that payment shall be made by the Director of the United Statt s Veterans Bureau to the estate of any decedent, such payment, if not over $500, may, under regulations prescribed by the Director, be made to the persons found by him to be entitled thereto, without the necessity of compliance with the requirements of law in respect of the administration of such estate

SEC. 309. Any person who charges or collects, or attempts to charge or collect, either directly or indirectly, any fee or other compensation for assisting in any manner a veteran, his dependents, or other beneficiary under this Act, in obtaining any of the benefits, privileges, or loans to which he is entitled under the provisions of this Act, shall upon conviction thereof, be subject to a fine of not more than $500 or imprisonment for not more than one year, or both.

SEC. 310. The decisions of the Secretary of War, the Secretary of the Navy, and the Director, on all matters within their respective jurisdictions under the provisions of this Act (except the duties vested in them by Title VII) shall be final and conclusive.

SEC. 311. Where the records of the War department or the Navy Department show that an application, disclosing an intention to claim the benefits of any provision of this Act, has been filed on or before January 2, 1930, and the application cannot be found, such application shall be presumed, in the absence of affirmative evidence to the contrary, to have been valid when originally filed.

In such case the Secretary of War or the Secretary of the Navy, as the case may be, shall not be required to transmit to the Director the application (as provided in sections 303 and 605) unless a new application is filed, in which case the new application shall be considered to have been filed on the date of filing of the lost application. (Effective May 19, 1924.)

SEC. 312.

- (a) If satisfactory evidence is produced establishing the fact of the continued and unexplained absence of any individual from his home and family for a period of seven years, during which period no intelligence of his existence has been received, the death of such individual as of the date of the expiration of such period shall, for the purposes of this Act, be considered as sufficiently proved.

- (b) If in the case of any such individual who is a veteran it appears that his application was not made and filed prior to the beginning of such seven-year period, or that although entitled to receive adjusted service pay he did not receive it prior to the beginning of such seven-year period, then his dependents who have made and filed application before the date of the expiration of such seven-year period (if such period began before January 3, 1930) shall be entitled to receive the amount of his adjusted service credit in accordance with the provisions of Title VI.

- (c) For the purposes of subdivision (b) of this section—

- (1) The widow shall be considered to be dependent within the meaning of section 602, if she was dependent at the beginning of such seven-year period or at any time thereafter and before the expiration of such period. The widow shall be presumed to have been dependent at the beginning of such seven-year period upon a showing of the marital cohabitation.

- (2) A child shall be considered incapable of self-support, within the meaning of section 602, if incapable of self-support by reason of mental or physical defect at the beginning of such seven-year period or at any time thereafter and before the expiration of such period.

- (3) The mother or father shall be considered to be dependent, within the meaning of section 602, if dependent at the beginning of such seven-year period or at any time thereafter and before the expiration of such period. If at the expiration of such seven-year period the mother is unmarried or over sixty years of age, or the father is over sixty years of age, such mother or father, respectively, shall be presumed to be dependent.

- (d) In the case of a veteran, if it appears that he is still living, payments to dependents in respect of his death shall cease, and, if he has filed a valid application under the provisions of section 302, any payments already made shall be deducted from the face value of his adjusted service certificate, or from the amount of his adjusted service credit if such credit is not more than $50. In the case of a dependent, if it appears that such dependent is still living, payments to dependents later in preference under this Act shall cease, and, if such dependent has filed a valid application under the provisions of section 604, the remainder of the payments shall be made in accordance with the provisions of Title VI. (This.section effective as of May 19, 1924.)

SEC. 313. That where any payment under this Act is to be made to a minor, other than a person in the military or naval forces of the United States or to a person mentally incompetent, or under other legal disability adjudged by a court of competent jurisdiction, such payment may be made to the legally constituted guardian, curator, or conservator of the person entitled to payment, or to the person found by the director to be otherwise legally vested with the care of the person entitled to payment or of his estate. Prior to the receipt of notice by the Bureau that any such person entitled to payment is under such legal disability, payment may be made to such person direct. (Effective May 19, 1924.)]

TITLE IV.—ADJUSTED SERVICE PAY

SEC. 401. There shall be paid to each veteran by the Director (as soon as practicable after receipt of an application in accordance with the provisions of section 302, but not before March 1, 1925), in addition to any other amounts due such veteran in pursuance of law, the amount of his adjusted service credit if, and only if, such credit is not more than $50.

SEC. 402. No right to adjusted service pay under the provisions of this title shall be assignable or serve as security for any loan. Any assignment or loan made in violation of the provisions of this section shall be held void. Except as provided in Title VI, the Director shall not pay the amount of adjusted service pay to any person other than the veteran or such representative of the veteran as he shall by regulation prescribe.

TITLE V.—ADJUSTED SERVICE CERTIFICATES

SEC. S02. The Director, upon certification from the Secretary of War or the Secretary of the Navy, as provided in section 303, is hereby directed to issue without cost to the veteran designated therein a non-participating adjusted service certificate (hereinafter in this title referred to as a "certificate") of a face value equal to the amount in dollars of 20-year endowment insurance that the amount of his adjusted service credit increased by 25 per centum would purchase, at his age on his birthday nearest the date of the certificate, if applied, as a net single premium, calculated in accordance with accepted actuarial principles and based upon the American Experience Table of Mortality and interest at 4 per centum per annum, compounded annually.

The certificate shall be dated, and all rights conferred under the provisions of this title shall take effect, as of the 1st day of the month in which the application is filed, but in no case before January I, 1925. The veteran shall name the beneficiary of

the certificate and may from time to time, with the approval of the Director, change such beneficiary. The amount of the face value of the certificate (except as provided in subdivisions (c), (d), (e), and (f) of section 502) shall be payable out of the fund created by section 505 (1) to the veteran twenty years after the date of the certificate, or (2) upon the death of the veteran prior to the expiration of such twenty-year period, to the beneficiary named; except that if such beneficiary dies before the veteran and no new beneficiary is named, or if the beneficiary in the first instance has not yet been named, the amount of the face value of the certificate shall be paid to the estate of the veteran.

If the veteran dies after making application under section 302, but before January 1, 1925, then the amount of the face value of the certificate shall be paid in the same manner as if his death had occurred after January 1, 1925

LOAN PRIVILEGES

SEC. 502.

- (a) A loan may be made to a veteran upon his adjusted service certificate only in accordance with the provisions of this section.

- (b) Any national bank, or any bank or trust company incorporated under the laws of any State, Territory, possession, or the District of Columbia (hereinafter in this section called "bank"), is authorized, after the expiration of two years after the date of the certificate, to loan to any veteran upon his promissory note secured by his adjusted service certificate (with or without the consent of the beneficiary thereof) any amount not in excess of the loan basis (as defined in subdivision (g) of this section) of the certificate.

The rate of interest charged upon the loan by the bank shall not exceed, by more than 2 per centum per annum, the rate charged at the date of the loan for the discount of 90-day commercial paper under section 13 of the Federal Reserve Act by the Federal reserve bank for the Federal reserve district in which the bank is located.

Any bank holding a note for a loan under this section secured by a certificate (whether the bank originally making the loan or a bank to which the note and certificate have been transferred) may sell 'he note to, or discount or rediscount it with, any bank authorized to make a loan to a veteran under this section and transfer the certificate to such bank.

Upon the indorsement of any bank which shall be deemed a waiver of demand, notice, and protest by such bank as to its own indorsement exclusively, and subject to regulations to be prescribed by the Federal Reserve Board, any such note secured by a certificate and held by a bank shall be eligible for discount or rediscount by the Federal reserve bank for the Federal reserve district in which the bank is located.

Such note shall be eligible for discount or rediscount whether or not the bank offering the note for discount or rediscount is a member of the Federal Reserve System and whether or not it acquired the note in the first instance from the veteran or acquired it by transfer upon the indorsement of any other bank.

Such note shall not be eligible for discount or rediscount unless it has at the time of discount or rediscount a maturity not in excess of nine months exclusive of days of grace. The rate of interest charged by the Federal reserve bank shall be the same as that charged by it for the discount or rediscount of 90-day notes drawn for commercial purposes.

The Federal Reserve Board is authorized to permit, or on the affirmative vote of at least five members of the Federal Reserve Board to require, a Federal reserve bank to rediscount, for any other Federal reserve bank, notes secured by a certificate. The rate of interest for such rediscounts shall be fixed by the Federal Reserve Board. In case the note is sold, discounted, or rediscounted the bank making the transfer shall promptly notify the veteran by mail at his last known post-office address.

(c) If the veteran does not pay the principal and interest of the loan upon its maturity, the bank holding the note and certificate may, at any time after maturity of the loan but not before the expiration of six months after the loan was made, present them to the Director. The Director may, in his discretion, accept the certificate and note, cancel the note (but not the certificate), and pay the bank, in full satisfaction of its claim, the amount of the unpaid principal due it, and the unpaid interest accrued, at the rate fixed in the note, up to the date of the check issued to the bank.

The Director shall restore to the veteran, at any time prior to its maturity, any certificate so accepted, upon receipt from him of an amount equal to the sum of (1) the amount paid by the United States to the bank in cancellation of his note, plus (2) interest on such amount from the time of such payment to the date of such receipt, at 6 per centum per annum, compounded annually. - (d) If the veteran fails to redeem his certificate from the Director before its maturity, or before the death of the veteran, the Director shall deduct from the face value of the certificate (as determined in section 501) an amount equal to the sum of

- (1) the amount paid by the United States to the bank on account of the note of the veteran, plus

- (2) interest on such amount from the time of such payment to the date of maturity of the certificate or of the death of the veteran, at the rate of 6 per centum per annum, compounded annually, and shall pay the remainder in accordance with the provisions of section 501.

- (e) If the veteran dies before the maturity of the loan, the amount of the unpaid principal and the unpaid interest accrued up to the date of his death shall be immediately due and payable.

In such case, or if the veteran dies on the day the loan matures or within six months thereafter, the bank holding the note and certificate shall, upon notice of the death, present them to the Director, who shall thereupon cancel the note (but not the certificate) and pay to the bank, in, full satisfaction of its claim, the amount of the unpaid principal and unpaid interest, at the rate fixed in the note, accrued up to the date of the check issued to the bank; except that if, prior to the payment, the bank is notified of the death by the Director and fails to present the certificate and note to the Director within fifteen days after the notice, such interest shall be only up to the fifteenth day after such notice.

The Director shall deduct the amount so paid from the face value (as determined under section 601) of the certificate and pay the remainder in accordance with the provisions of section 501. - (f) If the veteran has not died before the maturity of the certificate, and has failed to pay his note to the bank or the Federal reserve bank holding the note and certificate, such bank shall, at the maturity of the certificate, present the note and:certificate to the Director, who shall thereupon cancel the note (but not the certificate) and pay to the bank, in full satisfaction of its claim, the amount of the unpaid principal and unpaid interest, at the rate fixed in the note, accrued up to the date of the maturity of the certificate.

The Director shall deduct the amount so paid from the face value (as determined in section soi) of the certificate and pay the remainder in accordance with the provisions of section sot. - (g) The loan basis of any certificate at any time shall, for the purpose of this section, be an amount which is not in excess of 90 per centum of the reserve value of the certificate on the last day of the current certificate year. The reserve value of a certificate on the last day of any certificate year shall be the full reserve required on such certificate, based on an annual level net premium for twenty years and calculated in accrodance with the American Experience Table of Mortality and interest at 4 per centum per annum, compounded annually.

- (h) No payment upon any note shall be made under this section by the Director to any bank, unless the note when presented to him is accompanied by an affidavit made by an officer of the bank which made the loan, before a notary public or other officer designated for the purpose by regulation of the Director, and stating that such bank has not charged or collected, or attempted to charge or collect, directly or indirectly, any fee or other compensation (except interest as authorized by this section) in respect of any loan made under this section by the bank to a veteran.

Any bank which, or director, officer, or employee thereof, who does so charge, collect, or attempt to charge or collect any such fee or compensation, shall be liable to the veteran for a penalty of Poo to be recovered in a civil suit brought by the veteran. The Director shall upon request of any bank or veteran furnish a blank form for such affidavit. - (i) The Director of the United States Veterans Bureau is authorized, through such officers and at such regional offices, sub-offices, and hospitals of the United States Veterans Bureau as he may designate, and out of the United States Government life insurance fund established by section 17 of the World War Veterans' Act, 1924, as amended, to make loans to veterans upon their adjusted service certificates in the same amounts and upon the same terms and conditions as are applicable in the case of loans made under this section by a bank, and the provisions of this section shall be applicable to such loans; except that the rate of interest shall be 2 per centum per annum more than the rate charged at the date of the loan for the discount of ninety-day commercial paper under section 13 of the Federal Reserve Act by the Federal Reserve bank for the Federal Reserve district in which is located the regional office, sub-office, or hospital of the United States Veterans Bureau at which the loan is made, [but in no event shall the rate of interest exceed 6 per centum per annum.]

- (j) For the purpose of enabling the Director to make such loans out of the United States Government life insurance fund the Secretary of the Treasury is authorized to loan not exceeding $25,000,000 to such fund with interest at the rate of 4 per centum per annum (beginning on the date the check for each amount loaned to a veteran is paid by the Treasurer of the United States), compounded annually, on the security of bonds held in such fund.

- (k) The disbursing officers of the United States Veterans Bureau shall be allowed credit in their accounts for all loans made in accordance with regulations and instructions of the Director.

SEC. 503. No certificate issued or right conferred under the provisions of this title shall, except as provided in section 502, be negotiable or assignable or serve as security for a loan. Any negotiation, assignment, or loan made in violation of any provision of this section shall be held void. If any person is named as beneficiary by the veteran as a consideration for the making of a loan to the veteran by such person or any other person, such naming shall be void.

Any person who accepts an assignment of a certificate or receives a certificate as security for a loan contrary to the provisions of this title, or who makes a loan to a veteran in consideration of the naming by the veteran of such person or any other person as beneficiary, shall be guilty of a misdemeanor and shall upon conviction thereof be fined not more than $soo or imprisoned not more than one year, or both.

SECS. 505-507. Administrative provision.

Sec. 508. Notwithstanding any other provision of this Act a veteran may, under regulations prescribed by the Director, name more than one beneficiary, and may from time to time, with the approval of the Director, change such beneficiaries. If the Director is unable to ascertain the beneficiary named by the veteran, payment shall be made to the estate of the veteran.

TITLE VI.-PAYMENTS TO VETERAN'S DEPENDENTS ORDER OF PREFERENCE

SEC. 601. If the veteran has died before making application under section 302, or, if entitled to receive adjusted service pay, has died after making application but before he has received payment under Title IV, then the amount of his adjusted service credit shall (as soon as practicable after receipt of an application in accordance with the provisions of section 604, but not before March 1925) be paid to his dependents, in the following order of preference:

- (1) To the widow;

- (2) If no widow entitled to payment, then to the children, share and share alike;

- (3) If no widow or children entitled to payment, then to the mother;

- (4) If no widow, children, or mother, entitled to payment, then to the father.

DEPENDENCY

SEC. 602.

- (a) No payment under section 601 shall be made to a widow if she has remarried before making and filing application, or if at. the time of the death of the veteran was living apart from him by reason of her own wilful act; nor unless dependent at the time of the death of the veteran or at any time thereafter and before January 3, 1930. The widow shall be presumed to have been dependent at the time of the death of the veteran upon a showing of the marital cohabitation.

- (b) Payment under section 601 shall be made to a child if

- (1) under "8 years of age at the time of the death of the veteran, or

- (2) at any time thereafter and before January 3, 1930, incapable of self-support by reason of mental or physical defect.

- (c) No payment under section 601 shall be made to a mother or father unless dependent at the time of the death of the veteran, or at any time thereafter and before January 3, 1930. If at the time of the death of the veteran or at any time thereafter and before January 3, 1930, the mother is 'unmarried or over 60 years of age, or the father is over 60 years of age, such mother pr father, respectively, shall be presumed to be dependent.

PAYMENT IN INSTALLMENTS

SEC. 603. The payments authorized by section 601 shall be made in ten equal quarterly installments, unless the total amount of the payment is less than $so, in which case it shall be paid on the first installment date. No payments under the provisions of this title shall be made to the heirs or legal representatives of any dependents entitled thereto who die before receiving all the installment payments, but the remainder of such payments shall be made to the dependent or dependents in the next order of preference under section 601. All payments under this title shall be made by the Director.

APPLICATION BY DEPENDENT

SEC. 604.

- (a) A dependent may receive the benefits to which he is entitled under this title by filing an application therefor with the Secretary of War, if the last service of the veteran was with the military forces, or with the Secretary of the Navy, if his last service was with the naval forces.

- (b) Applications for such benefits, whether vested or contingent, shall be made [and filed] by the dependents of the veteran on or before January ID, 19303; except that in [the] case of the death of the veteran during the six months immediately preceding such date the application shall be made [and filed] at any time within six months after the death of the veteran. Payments under this title shall be made only to dependents who have made [and filed] application in accordance with the provisions of this subdivision.

- (c) An application shall be made [and filed]

- (1) personally by the dependent [if sixteen years of age or over,] or

- (2) in case physical or mental incapacity [or legal disability] prevents the making [or filing] of a personal application, then by such representative of the dependent and in such manner as the Secretary of War and the Secretary of the Navy shall jointly by regulation prescribe. An application made [or filed] by a person other than the representative authorized by such regulation shall be held void.

- (d) The Secretary of War and the Secretary of the Navy shall jointly make any regulations necessary to the efficient administration of the provisions of this section.

SEC. 605.

- (a) As soon as practicable after the receipt of a valid application the Secretary of War or the Secretary of the Navy, as the case may be, shall transmit to the Director the application and a certificate setting forth—

- (1) That a valid application has been received;

- (2) The name and address of the applicant;

- (3) That the individual upon whom the applicant bases his claim to payment was a veteran;

- (4) The name of such veteran and the date and place of his birth; and

- (5) The amount of the adjusted service credit of the veteran. (Omission.)

- (b) Upon receipt of such certificate the Director shall proceed to extend to the applicant the benefits provided in this title if the Director finds that the applicant is the dependent entitled thereto.

ASSIGNMENTS

SEC. 606. No right to payment under the provisions of this title shall be assignable or serve as security for any loan. Any assignment or loan made in violation of the provisions of this section shall be held void. The Director shall not make any payments under this title to any person other than the dependent or such representative of the dependent as the Director shall by regulation prescribe.

DEFINITIONS

SEC. 607. As used in this Act—

- (a) The term "dependent" means a widow, widower, child, father, or mother;

- (b) The term "child" includes (1) a legitimate child; (2) a child legally adopted; (3) a stepchild, if a member of the veteran's household; (4) an illegitimate child, but, as to the father only, if acknowledged in writing signed by him, or if he has been judicially ordered or decreed to contribute to such child's support, or has been judicially decreed to be the putative father of such child;

- (c) The terms "father" and "mother" include stepfathers and stepmothers, fathers and mothers through adoption, and persons who have, for a period of not less than one year, stood in loco parentis to the veteran at any time prior to the beginning of his service; and

- (d) The term "widow" includes "widower."

SEC. 608. If the veteran died while in the service and before July 1, 1919, and if an adjusted service credit has been or is, after this section takes effect, certified to the Director, then the sum of $60 shall be paid in a lump sum to the dependents of such veteran in the same manner as is provided in sections 601 and 602 of this Act.

SEC. II. This Act shall not invalidate any payments made or applications received under the World War Adjusted Compensation Act before the enactment of this Act. Payments under awards heretofore or hereafter made shall be made to the dependent entitled thereto regardless of change in status, unless another dependent establishes to the satisfaction of the Director a priority of preference under such Act as amended by this Act. Upon the establishment of such preference the remaining installments shall be paid to such dependent, but in no case shall the total payments under Title VI of such Act (except section 608) exceed the adjusted service credit of the veteran.

TITLE VII-MISCELLANEOUS PROVISIONS

SEC. 701. Administrative provisions.

SEC. 702. Whoever knowingly makes any false or fraudulent statement of a material fact in any application, certificate, or document made under the provisions of Title III, IV, V, VI, or VII, or of any regulation made under any such title, shall, upon conviction thereof, be fined not more than $1,000, or imprisoned not more than five years, or both.

SEC. 703. Administrative provisions.

SEC. 704. Whoever falsely makes, forges, counterfeits, or alters, or causes or procures to be made, forged, counterfeited, or altered, or willingly aids or assists in falsely making, forging, counterfeiting, or altering an adjusted service certificate issued under authority of this Act, or whoever passes, utters, publishes, or sells, or attempts to pass, utter, publish, or sell, any such false, forged, counterfeited, or altered certificate, with intent to defraud the United States or any person, or whoever has in possession any such falsely made, forged, counterfeited, or altered certificate, with intent to unlawfully use the same, shall be punished by a fine of not more than $5,000 and imprisonment not more than fifteen years.

The Secretary of the Treasury is hereby authorized to direct and use the Secret Service Division of the Treasury Department to detect, arrest, and deliver into the custody of the United States marshal having jurisdiction any person or persons violating any of the provisions of this section.

SEC. 705. Whenever it appears to the Director, by evidence clear and satisfactory to him, that any adjusted service certificate has, without bad faith upon the part of the person entitled to payment thereon, been lost [or destroyed,] and such adjusted service certificate is identified by number and description, he shall under such regulations and with such restrictions as to time and retention for security or otherwise as he may prescribe, issue a duplicate thereof of like value in all respects to the original certificate and so marked as to show the original number of the certificate lost, [or destroyed,] and the date thereof.

The lawful holder of such certificate who makes application for a duplicate shall (omission) file in the United States Veterans Bureau a bond in a penal sum of the face value of such lost, [or destroyed] certificate, with two good and sufficient [sureties], residents of the United States, to be approved by the Director, with condition to indemnify and save harmless the United States from any claim upon such lost, [or destroyed,] certificate; except that a duplicate certificate shall be issued without the requirement of a bond when it is shown to the satisfaction of the Director that the original certificate,

- (1) before delivery to the veteran, has been lost, destroyed, wholly or in part, or so defaced as to impair its value, and

- [(2) after delivery to the veteran, has, without bad faith upon the part of the person entitled to payment thereon, been partially destroyed or defaced so as to impair its value, is capable of identification, and is surrendered by such person to the Veterans Bureau.]

SEC. 7. This Act shall not invalidate any payments made or applications received, before the enactment of this Act, under the World War Adjusted Compensation Act, as amended. Payments under awards heretofore or hereafter made shall be made to the dependent entitled thereto regardless of change in status, unless another dependent establishes to the satisfaction of the Director a priority of preference under such Act as amended. Upon the establishment of such preference the remaining installments shall be paid to such dependent, but in no case shall the total payments under Title VI of such Act, as amended (except section 608), exceed the adjusted service credit of the veteran.