Soldier & Sailor Money Matters After Discharge - 1919

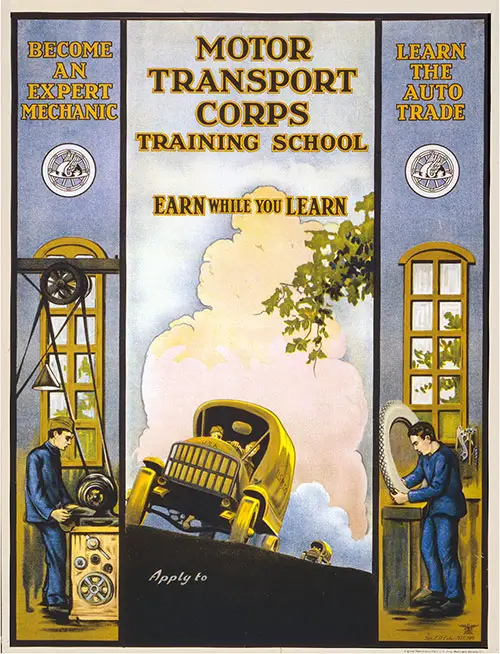

Motor Transport Corps Training School Earn While You Learn. U.S. Army Motor Transport Corps Recruiting Poster Showing Two Men Working in an Auto Repair Shop, Also Shows Truck from the Army Motor Transport Corps. Drawn by Sgt. E.R. Euler, MTC, 1919. Library of Congress LC # 00651837.GGA Image ID # 1970a078a0

When Am I Going To Be Discharged?

It is the policy of the War Department to discharge all enlisted personnel at the earliest possible moment, excepting those who enlisted in the old Regular Army prior to April 1, 1917, and those physically incapacitated by wounds of battle, accident, or disease. The physically incapacitated will be sent direct from the ports of debarkation to appropriate service hospitals.

Discharges will be accomplished at the demobilization centre nearest your home. According to the Chief of Staff, it should not take more than 48 hours in the case of any individual soldier arrived from overseas at a demobilization camp, with his papers and records in proper form, to effect his discharge.

Men without service records, under Circular 148, War Department, 1918, may be discharged on supplementary service records based on their affidavits.

If any organization drawn from a particular locality, having arrived for demobilization, wishes to parade, it is the policy of the War Department to authorize the parade and help in every possible way; but when this would involve remaining in the service for weeks awaiting the arrival of other units of the same division, parading must be voluntary.

The Money End of It

On the day, an officer or enlisted man is discharged, these things happen to him financially:—

- His pay and any allotments he may have made, cease. Allowances to dependent relatives, however, will continue for one month thereafter.

- If he is from overseas, he resumes the payment of postage.

- He receives a bonus of $60.00 when "honorably" discharged.

- He is paid a travel allowance of 5c a mile from the place of his discharge to the place where he was inducted into the service, or to his actual bona fide home or residence.

Enlisted men discharged between November 11, 1918, and February 28, 1919, and later, who received 3 1/2 cents per mile travel allowance, are now allowed the difference between 3 1/2 cents and 5 cents, or 1 1/2 cents a mile, according to a decision of the Comptroller of the Treasury dated April 17, 1919. Application should be made to The Zone Finance Officer, Lemon Building, Washington, D. C.

Write in the lower left corner of the envelope:

Attention Additional Travel Pay Section.

An officer's travel allowance is computed at 4c a mile from the place of discharge to the place of acceptance of his commission, or to the place of his original entry into service.

In addition to this travel allowance, officers and enlisted men are entitled to purchase a ticket home for two-thirds of the regular fare, providing that the purchase is made, and the journey begun within 24 hours after being discharged.

In the case of a draft man, this place is where the Local Board which inducted him "for immediate military service" was located, and not the place from which he was summoned to appear before the Local Board.

In the case of a National Guardsman it is the rendezvous where his organization was mustered into the Federal Service.

Your War-Risk Insurance

Hold on to your insurance, and pay the premiums when due, no matter what sacrifice this may entail. There is nothing which makes for self-respect so much as a consciousness that one is insured. There is no greater boon in our modern civilization than life insurance. The man who can't afford to die can't afford to live.

The Government's plan of insurance and compensation, with its provisions covering disability, was devised to take the place of a pension system. Therefore don't you, and don't let any pal of yours with whom you may have any influence, drop insurance.

Your present insurance is what is known as one-year renewable term insurance.

It is an emergency war-time measure. In recognition of your services, and of the necessity of providing for your dependents, the Government, instead of charging you a higher rate of premium than civilians, provided and provides insurance at a lower rate than a civilian could possibly obtain it. This is possible because the Government charges the policyholders nothing for administration, and bears the extra mortality costs.

In other words, the rate which you have been paying for your insurance from the day you entered the military or naval establishment until this time, is a net peace-time rate. This one-year renewable term insurance may be carried by you for five years after the declaration of peace, with the privilege of converting it at any time during that period, without having to undergo a medical examination, into one of the so-called permanent forms.

Uncle Sam is willing to accept you as a risk on the basis of what you were when you entered the service, no matter what may have happened to you since.

There are six of these forms:-

- A. Ordinary Life Policy

- B. 20-Payment Life Policy

- C. 30-Payment Life Policy

- D. 20-Year Endowment

- E. 30-Year Endowment

- F. Endowment policy maturing at age 62

The premium rates for the permanent forms are shown in the following tables:

| $1,000 INSURANCE (Permanent Forms) | ||||

Age |

Ordinary Life |

20-Payment Life | ||

Monthly |

Annual |

Monthly |

Annual | |

20 years |

$1.15 |

$13.58 |

$1.76 |

$20.79 |

25 years |

1.29 |

15.24 |

1.91 |

22.56 |

30 years |

1.47 |

17.36 |

2.10 |

24.81 |

35 years |

1.70 |

20.08 |

2.33 |

27.52 |

40 years |

2.01 |

23.74 |

2.62 |

30.95 |

45 years |

2.43 |

28.71 |

2.99 |

35.32 |

50 years |

3.01 |

35.56 |

3.50 |

41.34 |

Age |

20-Yr. Endowment |

30-Yr. Endowment | ||

Monthly |

Annual |

Monthly |

Annual | |

20 years |

$3.31 |

$39.10 |

$2.06 |

$24.33 |

25 years |

3.33 |

39.34 |

2.09 |

24.69 |

30 years |

3.36 |

39.69 |

2.15 |

25.40 |

35 years |

3.41 |

40.28 |

2.24 |

26.46 |

40 years |

3.51 |

41.46 |

2.41 |

28.47 |

45 years |

3.68 |

43.47 |

2.68 |

31.66 |

50 years |

3.98 |

47.02 |

3.14 |

37.09 |

This permanent insurance will be written and carried by the Government at rates considerably lower than regular life insurance companies granting similar benefits.

The premium rates are net rates based upon the American Experience Table of Mortality, with interest at 3 ½ %, figured upon a monthly basis.

Expenses of administration are paid by the Government, and are not charged against the insurance, thereby granting the insured a net rate.

The insurance is incontestable for any reason from the date of issue. It stands as written. Only you can void it by failing to pay the premium when due. No creditor, no tax collector, no court can touch it.

You may designate as beneficiary only a spouse, child, grandchild, brother, sister, parent, or grandparent. At any time, a new beneficiary within this class may be designated.

If you have not yet named a beneficiary in your insurance policy, and you should die without naming one, your insurance benefit will go to those in the permitted class who are entitled by the law of your State to inherit your personal property.

These policies have a loan and cash value beginning at the end of the first year, and loans are obtainable thereon up to 94% of the cash value.

Make no move toward converting your insurance into any one of the foregoing permanent forms without having the fullest advice from The Bureau of War Risk Insurance.

The Bureau will be ready to begin writing the permanent forms after June 1, 1919. Give no heed to Guard House or Sea Lawyers who may try to make you believe that they know all about it.

You have five years in which to come to a decision in this matter, but you have only 30 days in which to pay a premium when due. Don't forget that.

Your premium on your present insurance is due on the first of the month following your discharge: and although you are entitled to 30 days' grace following the due date, try your utmost to pay each month in advance.

The best means of transmitting your premiums is by postal or express money order, made payable to the Treasurer of the United States.

Checks are all right, too, but not everybody has a checking account. Checks also should be made payable to the Treasurer of the United States.

Do not, however, make the mistake of sending your premiums to the Treasurer of the United States. Address the envelope thus:

Premium Receipt Section,

Bureau of War Risk Insurance,

Treasury Department,

Washington, D. C.

It should be obvious why the transmission of premiums by means of postal or express money orders is recommended. You get an immediate receipt for your money.

Always, in making a remittance, be sure to give your full name, rank, organization, army serial number, the number of your insurance certificate, if you know it, and the month for which you are paying.

If you have failed to pay your premiums since discharge, don't wait to catch up; buy a money or express order immediately, and enclose it with a signed request that your insurance be reinstated.

However, no matter what happens, don't lose your nerve. A man's not dead until he's six feet under. Stick out your jaw and write The Bureau of War Risk Insurance, and you'll perhaps find out that it's really more generous than its austere legal words indicate.

Re-enlistment will give opportunity for a reinstatement of lapsed insurance.

A discharged soldier, sailor or marine who failed to take any insurance at the time of enlistment or induction and who has gone back to civil life again, may take out insurance upon re-enlistment.

The one-year renewable war risk or temporary insurance has no surrender value. If you let it go by the board, you get nothing back. The cake has been eaten.

Your present premium rates will hold good under any circumstances until July 1, 1919, and it would hold good until July I, 1920, if you took out your insurance after July 1, 1918.

Thereafter, in paying premiums, take into account whether your increased age since the date the insurance was issued calls for an increase of premium.

This also applies to policyholders abroad as well as at home. Compute premiums from the following table by multiplying the rate for a given age by the number of thousands for which you are insured:

Monthly Premiums for Each $1, 000 of Insurance

[Each $1,000 of insurance is payable in installments of $5.75 per month for 240 months; but if the insured is totally and permanently disabled and lives longer than 240 months, the payments will be continued as long as he lives and is so disabled.]

Age |

Monthly Premium |

|

Age |

Monthly Premium |

15 |

$0.63 |

|

41 |

$0.82 |

16 |

.63 |

|

42 |

.84 |

17 |

.63 |

|

43 |

.87 |

18 |

.64 |

|

44 |

.89 |

19 |

.64 |

|

45 |

.92 |

20 |

.64 |

|

46 |

.95 |

21 |

.65 |

|

47 |

.99 |

22 |

.65 |

|

48 |

1.03 |

23 |

.65 |

|

49 |

1.08 |

24 |

.66 |

|

50 |

1.14 |

25 |

.66 |

|

51 |

1.20 |

26 |

.67 |

|

52 |

1.27 |

27 |

.67 |

|

53 |

1.35 |

28 |

.68 |

|

54 |

1.44 |

29 |

.69 |

|

55 |

1.53 |

30 |

.69 |

|

56 |

1.64 |

31 |

.70 |

|

57 |

1.76 |

32 |

.71 |

|

58 |

1.90 |

33 |

.72 |

|

59 |

2.05 |

34 |

.73 |

|

60 |

2.21 |

35 |

.74 |

|

61 |

2.40 |

36 |

.75 |

|

62 |

2.60 |

37 |

.76 |

|

63 |

2.82 |

38 |

.77 |

|

64 |

3.07 |

39 |

.79 |

|

65 |

3.35 |

40 |

.81 |

|

|

|

Disability

All policies to be issued by the Government will, like the war-time form, contain a disability clause.

If at any time while these policies are in full force, you should become permanently disabled, you will receive a monthly installment of $5.75 for each thousand dollars of insurance, as long as the disability lasts, and throughout your life-time, if the disability continues.

The loss of both arms, both legs or both eyes may be defined as a total and permanent disability.

Disability benefits will be paid, whether the disability occurred before or after your discharge. Do not be confused as to the disability benefit to which you are entitled under your insurance policy, and compensation.

Compensation

Compensation does not mean disability—nor disability, compensation. In other words, even if a soldier or sailor is without a cent of Government insurance, he is entitled to receive compensation for injury or disease which prevents his earning as much as he did before he went into the Army or Navy, unless such injury or disease was caused by his own misconduct or not in the line of duty, and everybody who has worn the 0. D., the Blue, or the Green knows the meaning of "not in the line of duty." Dismissal or dishonorable discharge cancels any and all rights to compensation.

Applications for compensation should be made direct to the Compensation Division of The Bureau of War Risk Insurance, Treasury Department, Washington, D. C., and it is up to the interested parties to make this application. although the Government has endeavored to connect with every possible applicant before discharging him.

The way to begin an application for compensation is to write to The Bureau of War Risk Insurance, and simply ask that you be sent a copy of Form 526, the title of which is "Application of Person Disabled in and Discharged from Service."

On the filing of an application for compensation, an investigation takes place to develop all of the facts.

Compensation may be obtained in a sum as high as $100 monthly, for a man permanently blind or bedridden; and this would be in addition to his insurance benefits, which in the case of a blind or bedridden man insured for $10,000, would be $57.50 monthly.

In case a man should discover within one year after separation from the service that he has sustained an injury or contracted disease in the line of duty in active service which may result in disability or death, but which did not disable him and of which he had no knowledge at the time of separation from the service, he should communicate the fact immediately to the Compensation Division of the Bureau of War Risk Insurance, giving his full name, Army serial number, if an enlisted man, rank or grade, and organization; the date of his discharge or separation from the service; and, if possible, the date of his injury or disability.

He should at the same time request to be furnished a certificate to the effect that at the time of his separation from the service he was suffering from a wound, injury or disease which is likely to result in death or disability.

This certificate must be obtained within one year from the date of separation from the service, and in order to obtain it the man must submit to a medical examination by a physician designated by the Bureau of War Risk Insurance.

No compensation shall be payable for death or disability which does not occur prior to or within one year from date of separation from the service.

No compensation is payable for disability unless claim is filed within five years after the date of separation from the service.

In order to procure compensation for disability the claimant shall submit to examination by a medical officer of the United States. If he refuses to submit to such examination, his right to compensation ceases.

Private Insurance

The Civil Relief Act provides that The Bureau of War Risk Insurance may aid members of the military establishment in protecting private insurance policies and fraternal benefit memberships from lapses due to non-payment of premium or dues while the holder thereof is in military service.

Those who have taken advantage of this provision must not forget to pay these back premiums to the insurance company, with accrued interest thereon, within one year after discharge, or if already discharged, within one year after the proclamation of peace.

Back Pay

If any pay is coming to you, you may obtain it at the station of discharge, although your service record has been lost or is missing. Circular No. 148, War Department, Washington, March 27, 1919, authorizes commanding officers to pay soldiers on the personal affidavit of the soldier that so much is due him.

Be careful, if you have occasion to make any of these affidavits, about every comma and period that goes into them.

If you are already out of the service, and any back pay is due you, you may obtain it by filing an application with The Director of Finance, Discharged Enlisted Men's Pay Branch, Munitions Building, Washington, D. C.

Such applications must state:—

- When, where and how much you were last paid.

- How much is claimed due.

- When and where you were discharged.

- The name of your organization.

- Your rank, grade and serial number.

- Any change in status since last paid.

Discharged sailors, applying for back pay, must file their claims with The Auditor for the Navy Department, Treasury Department, Washington, D. C.

Discharged marines will apply to The Paymaster, U. S. Marine Corps. A statement of facts corresponding to those described in the foregoing paragraph is necessary.

Allotments to Dependents

If an enlisted man is informed prior to discharge that no payments whatever have been made upon his Class A or Class B allotments, let him consult his organization commander immediately, and request compliance with Circular No. 63, War Department, Washington, February 6, 1919.

In the case of a man discharged prior to February 6, 1919, he should write to the Allotment and Allowance Division, The Bureau of War Risk Insurance, Treasury Department, Washington, D. C., setting forth the following facts:

- First, middle and last name. (Print 'em.)

- Rank and organization at time allotment was made

- Army serial number.

- Name of allottee.

- Address of allottee. (Past and present.)

- Kind of allotment. (If Class B give relationship.)

- Amount of allotment.

- Total amount deducted from pay on account of allotment reckoned to include date of discharge.

- Date allotment became effective.

- Date of discharge.

- Future address of enlisted man.

- Whether the one making the allotment claimed exemption from compulsory allotment.

- Whether the one to whom the allotment was made has received any payment at all, and when.

In the case of the non-payment of a Class E (non-compulsory) allotment, present the foregoing facts in writing to The Zone Finance Officer, Allotment Branch, Washington, D. C.

It takes the Bureau of War Risk Insurance about a month to investigate and settle claims. Payment is ordinarily made by check.

Whether a man remains in or gets out of the service will not affect the expedition of claims falling within this category.

Officers who have allotments, or who are responsible for the certification of final payrolls or final statements of enlisted men, are responsible for the rendition to the Zone Finance Office, and to the Bureau of War Risk Insurance, Washington, D. C., of the proper discontinuance reports. Full instructions covering such discontinuance are given in Circular 85, W. D., 1918.

In all matters affecting allotments made by sailors to banks and trust companies inquiries should be directed to The Disbursing Officer, Bureau of Supplies and Accounts, Navy Allotment Section, Navy Department, Washington, D. C. Marines must direct inquiries to The Paymaster, U. S. Marine Corps, Washington, D. C.

Those Liberty Bonds

Liberty Bonds purchased under the monthly allotment system may be obtained from The Zone Finance Officer, Allotment Branch, Bond Section, Munitions Building, Washington, D. C. This is the only place to request delivery, either in person or by letter.

A bond purchaser may designate any address for the delivery of his bond or bonds. He may designate any third person, bank or individual, to receive his bond or bonds.

One whose discharge from the service takes place prior to the completion of full payment of allotments may obtain his bond or bonds by sending a postal money order for the amount due to The Zone Finance Officer, Washington, D. C.

Installments will not be accepted. If he does not wish to do this, he has the right to decline acceptance of his bond or bonds, and receive a refund on his final payroll or final statement of all he has paid.

Thus far the Government has fixed no time limit within which he shall do one or the other. Nevertheless it is advisable to clear up the transaction at the earliest possible moment.

When allotments have been made to private banks or trust companies, no refund will be made on final payrolls. Arrangements in such cases must be made with the banks or trust companies as to completion of payments or the settlement of accounts.

All of the foregoing applies to sailors and marines except that they do business with the Disbursing Officer, Bureau of Supplies and Accounts, Liberty Loan Section, Navy Department, Washington, D. C., and not with The Zone Finance Officer.

Income Tax

If you have not rendered an Income Tax Return for the calendar year 1918 to the Collector of the District in which you claim your legal residence, you should do so at once, provided your income exceeds the exemptions as authorized by law.

The military and naval exemption is $3,500. This applies only to salary or compensation in any form from the United States during the present war for active service in the military or naval forces.

The personal exemption, which is additional to the military and naval exemption, is $1000 for a single person; $2000 for a married person. In addition, a further exemption of $200 is allowed for each dependent person under 18 years of age, incapable of self-support, and receiving his chief support from the taxpayer.

If the net income exceeds the exemptions specified above, i. e., $3500 plus $1000 for a single parson; $3500 plus $2000 for a married person, you should use reasonable diligence after your arrival from overseas in filing your return, which should be accompanied with remittance of your tax. By reasonable diligence is meant—not loafing on the job.

An affidavit to the effect that you have been absent from the United States in the military or naval service must accompany your return. During the calendar year of 1917 there was no class exemption for those in the military or naval service, but only the personal exemption of $1000 for unmarried and $2000 for married persons.

The foregoing applies to all returning to the United States prior to the proclamation by the President of the declaration of peace. All who remain abroad in the military or naval service must file a return within ninety days after proclamation by the President of the end of the war with Germany.

For failing to make return within the specified time, there is a penalty of $1000 and in addition 25 percent of the amount of the tax due.

William Brown Meloney, "Where Do We Go From Here? - This Is the Real Dope: Living Off the Land - Options for Dicharged Soldiers and Sailors," Baltimore: Thomsen-Ellis Press, 1920.